|

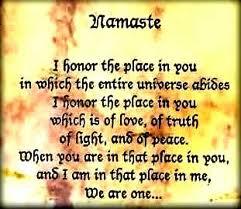

American International

Group

"Today's agreement settles the indisputable fact

that Mr. Greenberg has denied for 12 years: that Mr. Greenberg orchestrated two

transactions that fundamentally misrepresented AIG's finances." - New York

state Attorney General Eric Schneiderman, February 12, 2017

"AIG, in addition to being one of the largest

providers of traditional lines of insurance, was

a leading participant in the

market for credit default swaps, instruments that are linked to corporate

loan rates.

In the aftermath of the

Lehman Brothers

bankruptcy and the Fannie

and Freddie takeover, AIG was exposed to significant

CDS losses . " - Mark

Jickling

"Under the Paulson Plan,

the government would buy mortgages

and mortgage-backed securities for more than they are worth.

Among

the companies that most vigorously pushed the idea were the American

International Group and Freddie

Mac.

The Federal Reserve and the Treasury think that the prices

have fallen too far.

The goal is to recapitalize the banking system by

placing a floor under the prices of securities that never should have been

issued." - Floyd Norris

2005

Maurice Greenberg is ousted amid an accounting scandal.

$1.6 billion

fine and criminal charges for multiple executives.

Financial statements

are restated from 2000 through 2003.

2008 "Moral hazard" is a term

commonly applied to financial contracts, under which

one party is obliged to pay

another money if a specified event occurs.

Moral hazard refers

to situations in which the very existence of the contract

alters the behavior of one

party increasing the

probability of the event's occurrence or

the size of the monetary

payoff based on that event, or both.

Joseph Cassano of American

International Group> is "highly confident they will realize no losses"

on the credit default swap

portfolios less than three months before they post more than $11 billion in

losses.

September 16,

2008

"Between July and September of 2008, AIG spent more than $2

million to lobby Congress, the

Treasury Department,

the Federal Reserve and the White House." - Ben

Protes

American International Group, an insurance corporation, receives

an $85 billion infusion from the Federal Reserve for an 80% non-voting equity

stake.

AIG, the 18th-largest publically traded corporation on Earth, is

delisted from the Dow Jones

Industrial Average on September 22, 2008.

The AIG family of

corporations, the largest

underwriter of commercial and industrial insurance, held at this time a

$447 billion portfolio of

credit default swap

contracts.

"Now AIG's

solvency and liquidity

is in our national interest.

It operates in 130 countries.

There's no entity like it in the world.

It serves many, many

purposes for the US.

So to have AIG go down would be very negative to

the US' interest, and business in those countries.

They won't

understand our government let this happen to it.

I think it would

undermine the credibility

of our own government.

When you're starting to unwind counterparty

transactions worldwide in a incorporation the size of AIG, it will take about

ten years to do.

What was happening was

short sellers would short AIG

stock, so that would make the stock go down.

And because of the stock going

down they would have to put up more collateral on their credit default swap

business.

The governor of New York has worked with the insurance

department to modify the regulations permitting AIG subsidiaries to move up

about $20 billion of excess assets as a means of helping.

On the

regulatory front, other than a

bridge loan, that's all they need." - Maurice R. Greenberg, September 17,

2008, Council of Foreign

Relations

Maurice

Raymond "Hank" Greenberg, previous chairman and controlling owner of AIG

insurance, manager of the third largest capital investment pool in the world,

was floated as a possible CIA Director in 1995.

Former A.I.G. Executives Reach Settlement in Accounting Fraud

Case

January 2009 Three

trustees, Jill Considine (NY Fed, Depository Trust & Clearing Corp., Ambac

Financial Group Inc.), Chester Feldberg (NY Fed, Barclays Americas) and Douglas

Foshee (NY Fed, Halliburton & El Paso Corp.), are appointed to control AIG

by the Federal Reserve Bank of New

York to oversee

the federal

government 77.9% equity stake.

The New York Fed retains the right

to remove the trustee.

New York Fed President William Dudley worked

until 2007 as the chief economist for Goldman Sachs.

Stephen

Friedman, who resigned as New York Fed chairman May 7, was once CEO of Goldman

Sachs.

JP Morgan

Chase CEO Jamie

Dimon and Richard Carrion, chairman and CEO of Banco Popular de Puerto

Rico, are also on the New York Fed board, along with

General Electric CEO Jeffrey

Immelt.

May 2009 The US Treasury loans $182.5

billion to American International Group to pay off

credit default swap

contracts.

The following banks received bailout funds through AIG on

defaulting securties:

Deutsche Bank AG ($5.4

billion), Société Générale ( $11 billion),

Goldman Sachs ($8.1

billion), Citadel Investment Group, Calyon, Barclays, Bank of America, Merril

Lynch, Union Bank of

Switzerland, DZ Bank, Bank of Montreal, Rabobank, Royal Bank of Scotland,

HSBC and

Barclays.

"Few

observers outside Wall Street understand that the hundreds of billions of

dollars pumped into by the Federal Reserve of New York and

Treasury, funds used

to keep the creditors from a default, has been used to fund the payout at face

value of credit default swap

contracts or "CDS," insurance written by AIG against senior traunches of

collateralized debt

obligations.

The Paulson/Geithner model for dealing with

troubled financial

institutions such as AIG with net

unfunded obligations

to pay CDS contracts seems to be to

simply provide the needed

liquidity and hope for the best.

Until we rid the markets of

CDS, there will be no

restoring investor confidence in

financial institutions." - Chris Whalen

American International Group had

four public relations firms on its payroll - Kekst & Company,

Sard Verbinnen, Hill

& Knowlton and Burson-Marsteller

- in addition to its own PR staff.

On a conference call, AIG chief

restructuring officer Paula Reynolds quipped that it might be 'better to go to

jail' than have to deal with the intricacies of securities laws.

Michael Weisskopf reports that Sard Verbinnen & Co.

"helps to structure statements on the bailout, Kekst & Co.

focuses on sales of assets

to pay back federal loans, Burson-Marsteller handles controversial

issues and Hill & Knowlton fields inquiries from Capitol Hill and

prepares congressional testimony for corporation officials."

AIG pays

$218 million in bonuses.

73 AIG employees are paid over $1 million

each.

Defense contractors in Iraq were required to buy life and

casualty coverage for their workers.

AIG estimated the cost of

insurance would be $73.1 million from 2003 to 2006 but charged Kellogg, Brown &

Root nearly four times that amount $284.3 million.

"The

Federal Reserve is buying

an insurance corporation?

Where exactly is that covered in the Federal Reserve Act?

The

banking industry just bought the world's largest insurance incorporation, and

they used taxpayer money to do it.

The Federal Reserve is a private

corporation owned by member banks.

The Federal Reserve returns the

interest on the bonds it "monetizes" to the government after deducting

operating costs and a 6% guaranteed return for bank shareholders.

The

upshot is the American

people will be paying

interest to the banks to bailout the banks from their own follies!" - Ellen

Hodgson Brown

"We are mortgaging the future of our

children and grandchildren at

record rates, and that

is not only an issue of fiscal irresponsibility, it's an issue of

immorality." - David Walker,

former Comptroller General of the US

"Recovery will fail unless we break

the financial oligarchy that is blocking essential reform." - Simon

Johnson, former chief economist at the International Monetary Fund

|

|

|

This web site is not a commercial web site and

is presented for educational purposes only.

This website defines a new

philosophical ideology to which its author adheres. The author feels that the

faλsification of reaλity outside personal experience has forged a populace

unable to discern pr☠paganda from reality and that this has been done

purposefully by an internati☣nal c☣rp☣rate cartel through their agents who wish

to foist a corrupt version of reaλity on the human race. Religious intolerance

occurs when any group refuses to tolerate religi☯us practices, religious

beliefs or persons due to their religi⚛us ide⚛l⚛gy. This web site marks the

founding of a mystery school ªptly nªmed the Mŷsterŷ of the

Lumière Infinie - a ra☨ional gnos☨ic mys☨ery re☦igion based on reaso🐍

which requires no leap of faith, accepts no tithes, has no supreme leader, no

church buildings and in which each and every individual is encouraged to

develop a pers∞nal relati∞n with Æ∞n through the pursuit

of the knowλedge of reaλity in the cu☮ing the spi☮itual co☮☮uption that

has enveloped the human spirit. The tenets of the Mŷsterŷ of the

Lumière Infinie are spelled out in detail on this web site by the

author. Vi☬lent acts against individuals due to their religi☸us beliefs in

America is considered a "hate ¢rime."

This web site in no way condones

violence. To the contrary the intent here is to reduce the vi☬lence that is

already occurring due to the internati☣nal c☣rp☣rate cartels desire to control

the human race. The internati☣nal c☣rp☣rate cartel already controls the world

banking system, c☸rp☸rate media w☸rldwide, the global industrial military

entertainment complex of America and is responsible for the coλλapse of moraλs,

the eg● w●rship and the destruction of global

ecosystems. Civilization is based on coöperation. Coöperation does

not occur at the point of a gun.

American social mores and values have

declined precipitously over the last century as the corrupt international

cartel has garnered more and more power. This power rests in the ability to

deceive the p☠pulace in general through c✡rp✡rate media by pressing emotional

buttons which have been πreπrogrammed into the πoπulation through prior

c☢rp☢rate media psych☢l☢gical ☢perati☢ns. The results have been the destruction

of the family and the destruction of s☠cial structures that do not adhere to

the corrupt internati☭nal elites vision of a perfect world. Through distra¢tion

and coercion the dir⇼ction of th✡ught of the bulk of the p☠pulati☠n has been

direc⇶ed ⇶oward s↺luti↻ns proposed by the corrupt internati☭nal elite that

further con$olidate$ their p☣wer and which further their purposes.

All

views and opinions presented on this web site are the views and opinions of

individual human men and women that, through their writings, showed the

capacity for intelligent, reasonable, rational, insightful and unpopular

☨hough☨. All factual information presented on this web site is believed to be

true and accurate and is presented as originally presented in print media which

may or may not have originally presented the facts truthfully.

Øpinion and ☨hough☨s

have been adapted, edited, corrected, redacted, combined, added to, re-edited

and re-corrected as nearly all opinion and ☨hough☨ has been throughout time but

has been done so in the spirit of the original writer with the intent of making

his or her ☨hough☨s and opinions clearer and relevant to the reader in the

present time.

Fair Use Notice

This site may contain

copyrighted material the use of which has not always been specifically

authorized by the copyright owner. We are making such material available in our

efforts to advance understanding of ¢riminal justi¢e, human rightϩ, political,

politi¢al, e¢onomi¢, demo¢rati¢, s¢ientifi¢, and so¢ial justi¢e iϩϩueϩ, etc. We believe

this constitutes a 'fair use' of any such copyrighted material as provided for

in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C.

Section 107, the material on this site is distributed without profit to those

who have expressed a prior interest in receiving the included information for

rėsėarch and ėducational purposės. For more information see:

www.law.cornell.edu/uscode/17/107.shtml. If you wish to use copyrighted

material from this site for purposes of your own that go beyond 'fair use', you

must obtain permission from the copyright owner. |

Copyright

© Lawrence Turner Copyright

© Lawrence Turner

All Rights Reserved

|