|

"Irving Fisher, advocated the stamp-scrip

(demurrage) system as the way out of the Great Depression:

"The correct

application of stamp scrip would solve the depression crisis in the US in three

weeks!"

Other economists agreed, but pointed out to

Treasury Undersecretary Dean

Acheson possible decentralizing political

effects.

Roosevelt responded by banning all emergency

currencies, choosing instead the

centralized solution of the New

Deal." - Charles

Eisenstein

1903

Tax exempt foundations begin

pushing the ideology of socialism.

1928

FDR

selected governor of New York.

Many of the worst banking scandals

occur under FDR's governorship.

"In practice, the Federal Reserve Bank of New

York became the fountainhead of the system of twelve regional banks,

for New York was the money market of the nation.

The other eleven banks

were so many expensive mausoleums erected to salve the local pride and quell

the Jacksonian fears of the hinterland.

Benjamin

Strong, president of the Bankers Trust was

selected as the first Governor of the Federal Reserve Bank of New York.

Under Benjamin Strong, the Reserve System was brought into interlocking

relations with the Bank of

England and the Bank of

France.

Benjamin Strong held his position as

Governor of the Federal Reserve

Bank of New York until his sudden death during a Congressional

investigation of the secret meetings in 1928 between Reserve Governors and

heads of European central banks." -

Ferdinand Lundberg

October 29,

1929

Share prices on the New York Stock Exchange

collapse.

Milton

Friedman and Anna Jacobson Schwartz argue in, "A Monetary History of the

US," the single biggest cause of the Great Depression was that the

Federal Reserve

let the money supply fall by

one-third, causing deflation.

"Let me end my talk

by abusing my status as an

official representative of the Federal Reserve. I would like to say to

Milton and Anna: Regarding the Great Depression. You're right, we did it." -

Ben Shalom Bernanke, 2002 birthday tribute

to Milton Friedman

Banks are allowed to fail in the same way that

Lehmann Brothers was allowed to fail September 15, 2008 causing a credit

crisis.

"It was not accidental. It was a carefully contrived occurrence.

The international bankers sought

to bring about a condition of despair here so that they might emerge as rulers

of us all." - Louis T.

McFadden

1931

Gerald Swope, an avid reader of

Edward Mandell

House, presents a proposal for recovery, the "Swope Plan".

Swope's

plan becomes Roosevelt's "New

Deal".

Backed by the same industrialists the New Order of Adolf

Hitler is the same as Roosevelt's New Deal - plans for

a corporate state.

Gerard Swope*, Owen

Young, and A. Baldwin of General Electric in the US were directors of

AEG.

General Electric helps finance the

Bolshevik Expansion.

Executive

offices of General Electric

are at 120 Broadway, New York.

When FDR is working on Wall Street, his

address is 120 Broadway.

The Roosevelt Warm Springs Institute for

Rehabilitation and the Franklin D Roosevelt Foundation is located at

120 Broadway.

The most prominent financial backer of an earlier

Roosevelt Wall Street venture from 120 Broadway is Gerard Swope of

General Electric.

"The Great Depression spawned

government involvement in business affairs and a new wave of business-related

litigation." - Sullivan &

Cromwell LLP

1933 "The smart thing to do

would be to go off the Gold Standard a little farther than England has

done." - Henry Agard Wallace, January 31, 1933

Roosevelt takes office,

defaults on the debt and takes the US off the

Gold Standard.

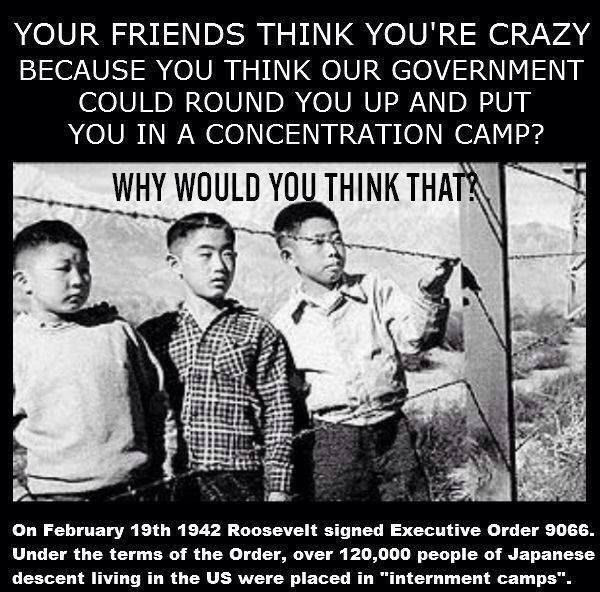

"By

February 19, gold withdrawals from banks increased from five to fifteen million

dollars a day.

In two weeks $114,000,000 of gold was taken from banks

for export and another $150,000,000 was withdrawn to go into hiding.

The infection of fear was

everywhere.

Factories are

closing.

Unemployment is rising rapidly.

Bank closings

multiplied daily." - John T. Flynn

Gold confiscation order pays

Americans $20.67 an ounce.

The world price of gold has been set since

1810 in the private bank of NM Rothschild & Sons in London, at 11:00 a.m.,

on a daily basis.

Paul Warburg and his

partners put their money into gold at $20.67 before the

stockmarket crash and ship it to London.

The official price of gold is

then raised to $35 per ounce.

They then ship it back and sell it to the

US Government for the new higher price of $35 per ounce for a profit of $14.33

on every ounce.

(Baron David de Rothschild withdrew NM Rothschild from

the gold market in 2005 shortly after this posting.)

Americans with gold

were paid $20.67 per ounce and those that refused to surrender their gold were

given a ten year prison sentence.

To store the confiscated gold

Fort Knox is built.

German General Electric (Deutsche

Edison-Gesellschaft für angewandte Elektrizität) is a prominent

financier of Adolf Hitler and the Nazi Party both directly and indirectly

through Osram.

International

General Electric in New York is a major participant in the ownership and

direction of both AEG and Osram.

"I regard the condition of the country

the most serious in its history. The

mere talk of inflation retards business. If you start talking about that

you would not have a nickel's worth of gold in the Federal Reserve the day

after tomorrow." - Bernard

Baruch, February 11, 1933

"One of the key Roosevelt advisors is

Bernard Baruch, a power in

the Wilson Administration." - Jewish Examiner of Brooklyn, October 20,

1933

June National Industrial Recovery Act

enacted.

Hugh S. Johnson, Raymond Moley, Donald Richberg,

Rexford Tugwell, Jerome Frank, and Bernard Baruch - key Roosevelt advisors -

claim unrestrained competition caused the Great Depression.

They claim

the government had a critical role to

play through national planning,

regulation, the

fostering of trade associations,

support for "fair" trade

practices and support for "democratization of the

workplace".

The New Deal -

a program of central control,

collectivism, similar to

fascism,

communism and

corporatism - is

accepted by the American people as

a viable alternative to

the rugged individualism of early

Americans.

Roosevelt institutes

a disastrous legacy of

agricultural subsidies and seeks to cartelize industry.

"It was

a crime against our civilization to pay farmers to destroy crops and limit

production. It was a shocking

thing to see the government pay one big sugar corporation over $1,000,000 not

to produce sugar." - John T. Flynn

Roosevelt took steps to

strengthen unions and

to keep real wages high.

This helped workers with jobs but

made it much harder for the

unemployed.

Unemployment rates remained

high for the duration of the New Deal.

Under

Herbert Hoover and continuing

with Roosevelt, the federal government increases

income taxes, excise

taxes, inheritance taxes, corporate income taxes, holding incorporation taxes

and "excess profits"

taxes.

The New Deal, "new economic order," is not a creature of

classical liberalism but a creature of

corporate socialism or

corporatism.

Big

business, as reflected in Wall Street, strived for a state order in which they

could control industry

and eliminate competition.

This is the core of the New Deal.

No one knows who was responsible for the gold confiscation order.

No Congressman ever claimed having written it.

FDR stated he

had not written it, nor had he even read it.

Secretary of the Treasury,

William H. Woodin, claimed he never read it.

He stated it was "what the experts

wanted."

1934

Retired Marine Corps Major General Smedley Butler testifies before

the Congressional McCormack-Dickstein Committee that

Wall Street bankers including

Guaranty Trust director Grayson

Murphy, JP Morgan,

DuPont,

Remington Arms, and other

interests are plotting to create

a fascist veterans'

organization with Butler as its leader to use in

a coup d'état to overthrow

FDR.

1935 Supreme Court unanimously

declares the National

Recovery Administration unconstitutional.

The National

Recovery Administration is headed by Hugh Johnson a business associate of

Bernard Baruch - a financial

supporter of Red

Zionism.

The National Recovery Administration allowed

industries to create "codes of fair

competition" set minimum

wages and maximum weekly hours while also allowing industry heads to

collectively set minimum prices.

"The National Recovery

Administration worked by fostering giant cartels, which made products

artificially expensive and punished small business trying to compete against

big business. The general lesson is that

government sponsored cartels don't help the economy as a whole. " - Robert

P. Murphy

1937 FED increased reserve

requirements for banks, thereby curbing lending and moving the economy back to

dangerous deflationary pressures.

Henry Wallace becomes Secretary of

Agriculture in Roosevelt's cabinet.

Wallace orders the

slaughtering of

pigs and plowing up of cotton

fields in rural America to drive up the price of these

commodities.

"The American fascist would prefer not to use violence.

His method is to poison the

channels of public information." - Henry Agard Wallace

September 2, 1939 Whittaker Chambers informs Adolf

Augustus Berle, Jr. that several senior government officials, including Alger

Hiss are members of a Soviet "apparatus" designed to influence US policy and

pass classified documents and information to the Soviets.

Adolf Augustus

Berle, Jr. told Chamber's that he and journalist, Isaac Don Levine, met with

Roosevelt and conveyed what Chambers told them, but Roosevelt unequivocally

refused to take any action.

Alger Hiss remains at the State

Department throughout WWII in positions

as Roosevelt's principal adviser on Soviet affairs at the Yalta conference, as a

delegate to the Dumbarton Oaks Conference and as Secretary General of the San

Francisco conference establishing the United Nations.

1941 Roosevelt names Henry Agard Wallace chairman

of the Board of Economic Warfare (BEW) and of the Supply Priorities and

Allocations Board (SPAB).

1944 Henry Agard

Wallace is wined and dined in Siberia by Sergei Goglidze and Dalstroi director

Ivan Nikishov, both NKVD generals.

Henry Agard Wallace becomes

a staunch supporter of the

Soviet Union.

Wallace is endorsed by the Communist Party

(USA).

Subsequent refusal to publicly disavow any Communist support

costs him the backing of anti-Communist liberals in the 1948 presidential

election.

"I reached

a conclusion, under no circumstances, have any business dealings with him."

- Henry Agard Wallace after getting

to know FDR

"The outright ownership of farms ought to be

greatly restricted.

Under intelligent state control it should be

possible to introduce a planned flexibility into the congestion and rigidity of

our outmoded system." - Rexford Tugwell Undersecretary of Agriculture

"I know of no severe depression, in any country or

any time that was not accompanied by a sharp decline in the stock of money, and

equally of no sharp decline in the stock of money that was not accompanied by

a severe

depression." - Milton

Friedman

May 2007 Federal

Reserve reports assets of about $836 billion, 92% of them are the

marketable securities.

By the

spring of 2008 the

value of marketable securities had dropped

to $500 billion and total asset value had remained level until September of

2008.

September 2008 The

Federal Reserve allows the Monetary

Base to increase from $836 billion to $1,479 billion.

By December

2008 95% of the Federal Reserve "assets" are

toxic collateralized debt

obligations.

"AIG, in addition to being one of the largest providers

of traditional lines of insurance, was

a leading participant in the

market for credit default swaps, instruments that are linked to corporate

loan rates.

In the aftermath of the

Lehman Brothers

bankruptcy and the Fannie and Freddie

takeover, AIG was exposed to significant CDS

losses . " - Mark Jickling

December 16, 2008

Federal Reserve cuts interbank lending rate to a range of 0% to

.25%.

"The banks have exchanged $2 trillion in toxic debt consisting

of Asset-Backed Securities in sub-prime

mortgages, stocks and other high-risk credits in exchange for cash and

US Treasury bonds.

The Federal

Reserve is holding some $2 trillion in toxic

debt.

Any release of information is opposed as that

might signal 'weakness'

and spur short selling or a run by

depositors.

The

Federal Reserve does not want to discuss this.

That is clearly also

behind their blunt refusal to reveal the nature of their $2 trillion assets

acquired from member banks and other financial institutions.

Simply

put, were the Fed to reveal to the public precisely what 'collateral' they held

from the banks, the public would know the potential losses that the government

may take." - F. William Engdahl 12/17/08

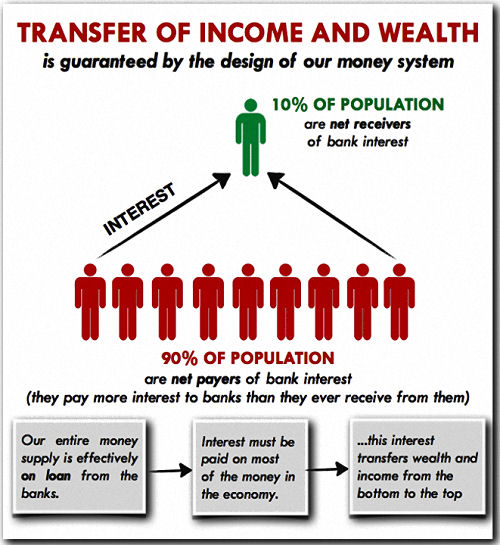

The interest tab to finance

federal government

expenditures is $412 billion in fiscal year 2008, or about one-third of the

federal government total income from personal income taxes which was $1,220

billion.

"The Fed Open Market

Committee authorized $300 billion in purchases of long term treasury bonds

for six months.

The central bank's latest efforts may help swell its

balance sheet to more than $4

trillion this year." - Scott Lanman, March 25, 2009

"The Federal

Reserve, like other regulators around the world, did not do all it could have

to constrain excessive risk-taking in the financial sector in the period

leading up to the crisis." - Ben Salom Bernanke, November 29, 2009

January 2009 Federal Reserve reports assets of $2.1 trillion,

an increase of $1.2 trillion from September 2008.

That represents loans

worth $1.2 trillion - a startling increase more than doubling the size of the

Monetary Base during the last quarter of 2008.

Ben Gisin, a former

banker tracking statistical releases, says he has never seen anything like it.

Fungible assets magically appear

on the Federal Reserve balance

sheet.

The Federal Reserve is paying out roughly $400 million a year

for "research" - much of it to outside economists who then advocate for

the Federal Reserve agenda without disclosing their Federal Reserve ties.

Seven of the eight economists on a 2009

anti-oversight letter to

Congress failed to note they are or were on the payroll of the Federal Reserve.

The Federal Reserve "so thoroughly dominates the field of economics

that real criticism of the central bank has become

a career liability for

members of the economic profession."

"Under a misguided set of international rules that took hold late

1990s, banks were allowed to set their capital requirements." - Joe Nocera

"To understand the real cause of the credit crisis

and how it can be reversed, we first need to understand credit itself what it

is, where it comes from, and what the real tourniquet is that has limited its

flow.

Banks actually create credit; and if private banks can do it, so

could public banks or public treasuries.

The crisis is not one of

"liquidity" but of "solvency."

It has been caused, not by the

banks' inability to get credit, but by their inability to meet the capital

requirement imposed by the Bank for

International Settlements, the private foreign head of the banking

system.

"The central bankers" central bank, the BIS pulls the strings of

the private international banking system from

Basel, Switzerland." - Ellen

Brown

"The Fed generates market activity by

creating incentives for

borrowing.

Borrowing leads to

speculation.

Speculation leads to

steadily rising asset

prices or asset price

inflation.

The Fed is not an unbiased observer of

free market activity.

The Fed fuels speculation

and controls behavior by fixing interest

rates.

The Fed IS the market, which is why it

is foolish to talk about a "recovery".

The idea of recovery implies a

system based on supply and demand.

The bottom line, is that the current

financial architecture is not designed to work; it is

designed to make a handful of speculators very

rich.

Speculators own Congress,

the White House and

financial

media, which is why there has been no meaningful change in regulations." -

Mike Whitney

"The Federal Reserve will ask

a US appeals court to block a ruling that for the first time would force the

central bank to reveal secret identities of financial firms that might have

collapsed without the largest

government bailout in US history." - David Glovin 01/11/10

Freedom of Information Act

requires federal agencies to make government documents available to the press

and public.

US District Judge Loretta Preska notes in her August 24,

2009 ruling that loan records are covered by Freedom of Information

Act and rejected the claim that their disclosure might harm banks and

shareholders.

"The Fed speculates on how a borrower might enter a

downward spiral of financial instability if its participation in the Federal

Reserve lending programs were to be disclosed. Conjecture, without evidence of

imminent harm, simply fails to meet the board's burden of proof." - US District

Judge Loretta Preska

In its appeal, the

Board of Governors of the

Federal Reserve System argued that

disclosure of "highly sensitive" documents, including 231 pages of daily

lending reports, threatens to stigmatize lenders and cause them "severe and

irreparable competitive injury."

"The stock of money, prices and output was

decidedly more unstable after the establishment of the Federal Reserve than

before.

Any system which gives

so much power and so much discretion to a few men is a bad system. "

- Milton Friedman

2009 "The

outbreak of the current crisis confront us with a long-existing but still

unanswered question, i.e., what kind of

international reserve currency do we need to secure global financial

stability?

Theoretically, an international reserve currency should

first be anchored to a stable benchmark and issued according to a clear set of

rules.

Second, its supply should be flexible enough to allow timely

adjustment according to the changing demand; third, such adjustments should be

disconnected from economic conditions and

sovereign interests.

The acceptance of credit-based national currencies as major

international reserve currencies, as is the case in the current system, is a

rare special case.

The crisis again calls for

creative reform of the

existing international monetary system towards an international currency with a

stable value.

Issuing countries of reserve currencies are constantly

confronted with the dilemma

between achieving their domestic monetary policy goals and meeting other

countries' demand for reserve currencies.

They may fail to adequately

meet the demand of liquidity, or create

excess liquidity in global markets by

stimulating domestic

demand.

The Triffin Dilemma - issuing countries of reserve

currencies cannot maintain the value of the reserve currencies while providing

global liquidity.

Increasing intensity of financial crises following the

collapse of the Bretton Woods

system suggests costs of such a system may have exceeded its

benefits.

[Nixon Ends Bretton Woods International Monetary

System]

The International

Monetary Fund created Special Drawing Rights when the defects of the

Bretton Woods system initially

emerge to mitigate risks.

Special Drawing Rights(SDR)

could be given a greater role.

The SDR has the potential to act as a

super-sovereign reserve currency.

SDR allocation increases allow the

Fund to address representational reform.

The SDR is an

accepted means of

payment in international trade.

The allocation of the SDR can be

shifted from a

purely calculation-based system to

a system backed by real assets,

such as a reserve pool.

To address the crisis

strengthen the role of the SDR and

maintain the stability of the international

monetary and financial system.

The IMF is endowed with a natural

advantage to act as the manager of its member countries' reserves." - Zhou

Xiaochuan, Bank of China 03/23/09 |

|

|

This web site is not a commercial web site and

is presented for educational purposes only.

This website defines a

new perspective with which to en❡a❡e Яeality to which its

author adheres. The author feels that the faλsification of reaλity

outside personal experience has forged a populace unable to discern

pr☠paganda from reality and that this has been done purposefully by an

internati☣nal c☣rp☣rate

cartel through their agents who wish to foist a corrupt Ѵersion of

Яeality on the human race. Religi☯us int☯lerance ☯ccurs

when any group refuses to tolerate religi☯us practices, religi☸us

beliefs or persons due to their philosophical ideology. This web site marks the

founding of a system of philºsºphy nªmed the Mŷsterŷ

of the Lumière Infinie - a ra☨ional gnos☨ic mys☨ery

re☦igion based on reaso🐍 which requires no leap of faith, accepts

no tithes, has no supreme leader, no church buildings and in which each and

every individual is encouraged to develop a pers∞nal relati∞n with

Æ∞n through the pursuit of the knowλedge of reaλity in

the cu☮ing the spi☮itual co☮☮uption that has enveloped

the human spirit. The tenets of the Mŷsterŷ of the Lumière

Infinie are spelled out in detail on this web site by the author. Vi☬lent

acts against individuals due to their religi☸us beliefs in America is

considered a "hate ¢rime."

This web site in no way

c☬nd☬nes vi☬lence. To the contrary the intent here is to

reduce the vi☬lence that is already occurring due to the

internati☣nal c☣rp☣rate cartels desire to

c✡ntr✡l the human race. The internati☣nal

c☣rp☣rate cartel already controls the world central banking system,

c☸rp☸rate media w☸rldwide, the global indus✈rial

mili✈ary en✈er✈ainmen✈ complex and is responsible for

the coλλapse of moraλs, the eg● w●rship and the

destruction of gl☭bal ec☭systems. Civilization is based on

coöperation. Coöperation with bi☣hazards of a

gun.

American social mores and values have declined precipitously over

the last century as the internati☣nal c☣rp☣rate cartel has

garnered more and more power. This power rests in the ability to deceive the

p☠pulace in general through c✡rp✡rate media by

press☟ng em☠ti☠nal butt☠ns which have been

πreπrogrammed into the πoπulation through prior

c✡rp✡rate media psychological operations. The results have been

the destruction of the fami♙y and the destruction of s☠cial

structures that do not adhere to the corrupt internati☭nal elites vision

of a perfect world. Through distra¢tion and ¢oer¢ion the

direction of th✡ught of the bulk of the p☠pulati☠n has been

directed toward solutions proposed by the corrupt internati☭nal elite

that further con$olidate$ their p☣wer and which further their purposes.

All views and opinions presented on this web site are the views and

opinions of individual human men and women that, through their writings, showed

the capacity for intelligent, reasonable, rational, insightful and unpopular

☨hough☨. All factual information presented on this web site is

believed to be true and accurate and is presented as originally presented in

print media which may or may not have originally presented the facts

truthfully. Øpinion and

☨hough☨s have been adapted, edited, corrected, redacted, combined,

added to, re-edited and re-corrected as nearly all opinion and

☨hough☨ has been throughout time but has been done so in the spirit

of the original writer with the intent of making his or her

☨hough☨s and opinions clearer and relevant to the reader in the

present time.

Fair Use Notice

This site may contain

copyrighted material the use of which has not always been specifically

authorized by the copyright owner. We are making such material available in our

efforts to advance understanding of ¢riminal justi¢e, human

rightϩ, political, politi¢al, e¢onomi¢,

demo¢rati¢, s¢ientifi¢, and so¢ial justi¢e

iϩϩueϩ, etc. We believe this constitutes a 'fair use' of any

such copyrighted material as provided for in section 107 of the US Copyright

Law. In accordance with Title 17 U.S.C. Section 107, the material on this site

is distributed without profit to those who have expressed a prior interest in

receiving the included information for rėsėarch and ėducational

purposės. For more information see:

www.law.cornell.edu/uscode/17/107.shtml. If you wish to use copyrighted

material from this site for purposes of your own that go beyond 'fair use', you

must obtain permission from the copyright owner. |

Copyright

© Lawrence Turner Copyright

© Lawrence Turner

All Rights Reserved

|