|

"Most if not all

derivatives contracts are predicated

on interest rates because

derivatives, to a great extent, are time-based.

Interest rates set a valuation on

derivatives products as they measure opportunity cost, i.e. the profit foregone

by putting money into product A when money could also theoretically be made by

investing in product B.

Manipulating

these rates, particularly in the interest of protecting derivatives

investment, does indeed gum up the "immense and recondite" financial machinery

of the world.

The interest rate derivatives market, in which the

underlying asset is the right to pay or to receive

a notional amount of money at a

given interest rate, is the single largest derivatives market.

The

Bank for International Settlements

(BIS) estimated that in June 2012 the value for over-the-counter

interest rate derivatives contracts

(in notational terms) totaled $835 trillion; 90 percent of the world's top 500

companies now use them to control their cash flows." - Patricia

Goldstone

"Between 1973 and 1985, US financial sector

accounted for about 16% of

domestic corporate profits.

In the 1990s, it ranged from 21% to 30%.

After

2000 it soared to 41%." - David Brooks

1960s

Finance and insurance together

account for less than 4% of G.D.P.

1980

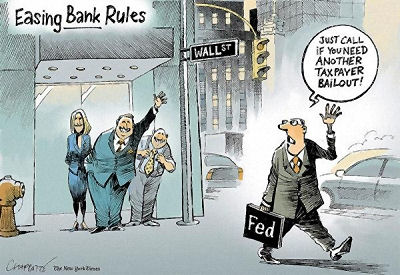

"After 1980, in the deregulation minded

Reagan era, old-fashioned banking was increasingly replaced by wheeling and

dealing on a grand scale.

Banks used securitization to increase their

risk. In the process they made the economy more vulnerable to financial

disruption." - Paul Krugman

03/26/09

1982

Dow Jones Industrial Average contains not a

single financial corporation.

1994

"The sudden failure or abrupt withdrawal from

trading of any of these large US dealers could cause

liquidity problems in the markets and could

pose risks to federally insured banks and the

financial system as a whole.

In

some cases intervention has and could result in a financial bailout paid for or

guaranteed by taxpayers."- Charles A. Bowsher, Comptroller General,

Government Accountability Office 1994

1997

Myron

Scholes, the "father" of financial derivatives, wins

the Riksbank Prize in Economics for inventing

the model that has led to financial derivatives.

Myron Scholes later

declares derivatives and

credit default swaps have gotten so

dangerously out of hand that authorities should shut down the market

and start over with regulation in place to begin with.

Brooksley E.

Born, Commodity Futures Trading

Commission chairwoman, is concerned that unfettered, opaque trading

could "threaten our regulated markets or, indeed, our economy without any

federal agency knowing about it," calls for greater disclosure of trades and

reserves to cushion against losses and seeks to extend the Commodity Futures

Trading Commission regulatory reach into derivatives.

Brooksley E.

Born's opinions incited fierce opposition from top officials of the

Treasury Department,

Federal Reserve and the

Securities and Exchange Commission

including Alan Greenspan* and Robert Edward

Rubin* who claim traders would take their business

overseas.

1998

"While

OTC derivatives serve

important economic functions, these products, like any complex financial

instrument, can present significant risks if misused or misunderstood.

A number of large, well-publicized financial losses over the last few

years have focused the

attention of the financial services industry, its regulators, derivatives

end-users and the general

public on potential problems and abuses in the OTC derivatives market." -

Commodity Futures Trading Commission, May 1998

What

is a 'Derivative'?

What is an 'Economic Derivative'?

An

insight into OTC Derivatives

November

1999

Larry Summers, deputy secretary of the

Treasury, Robert Edward Rubin,

secretary of the Treasury, and Alan

Greenspan, the chairman of the Federal Reserve work overtime to insure that

derivatives are not regulated.

Larry

Summers testifies before Congress that "the shadow of regulatory

uncertainty over an

otherwise thriving market - raised risks for the stability and competitiveness

of American derivative trading."

Larry Summers blasted the Commodity

Futures Trading Commission for having raised" the possibility of regulation

over this market."

Even "small regulatory changes," Larry Summers

cautioned, could throw the whole system out of whack.

Larry Summers,

Alan Greenspan and

Robert Edward Rubin recommend that

Congress permanently strip the Commodity Futures Trading

Commission of regulatory authority over derivatives.

Larry Summers' Debt Swap

2000

David X. Li's Gaussian

copula function

Li was born as Li Xianglin and raised in a rural part of

China during the 1960s.

His family was relocated during the Cultural

Revolution to a rural village in

southern China for "re-education". |

MERS

"The

development of "electronic" mortgages managed by MERS went hand in hand with

the "securitization" of mortgage loans chopping them into pieces and selling

them off to investors.

In the heyday of mortgage securitizations,

before investors got wise, lenders would slice up loans, bundle them into

"financial products" called "collateralized debt obligations" (CDOs),

ostensibly insure them

against default by wrapping them in derivatives called "credit default

swaps," and sell them to pension funds, municipal funds and foreign

investment funds.

There were many secured parties, and the pieces kept

changing hands; but MERS supposedly kept track of all these changes

electronically.

MERS would register and record mortgage loans in its

name, and it would bring foreclosure actions in

its name.

MERS facilitated the rapid turnover of mortgages and

mortgage-backed securities while serving as a "corporate shield" that protects

loan originators from claims by borrowers of

predatory lending practices." -

Ellen Brown

"MERS has reduced transparency in the mortgage market

in two ways.

First, consumers and their counsel can no longer turn to

the public recording systems to learn the identity of the holder of their note.

Today, county recording systems are increasingly full of one

meaningless name, MERS, repeated over and over again.

But more

importantly, all across the country, MERS now brings foreclosure proceedings in

its name even though it is not the financial party of interest.

This

is problematic because MERS is not equipped to provide responses to consumers'

discovery requests with respect to predatory lending claims.

In

effect, the securitization conduit attempts to use

a faceless and seemingly

innocent proxy with no knowledge of

predatory origination or servicing behavior to do

the dirty work of seizing the consumer's

home.

MERS actually

succeeds in foreclosing without producing the original note "the legal sine

qua non of foreclosure" much less documentation that could support predatory

lending defenses." - Timothy McCandless

"MERS as

straw man lacks standing

to foreclose, but so does original lender, although it was a signatory to the

deal.

The lender lacks standing because title had to pass to the

secured parties for the arrangement to legally qualify as a

"security."

The lender, paid in full, has no further legal interest in

the claim.

Only the securities holders have

skin in the game; but

they have no standing to foreclose, because

they were not signatories to the original agreement.

They cannot satisfy

the basic requirement of contract

law that a plaintiff suing

on a written contract must produce a signed contract proving he is

entitled to

relief." - Ellen Brown

ABX

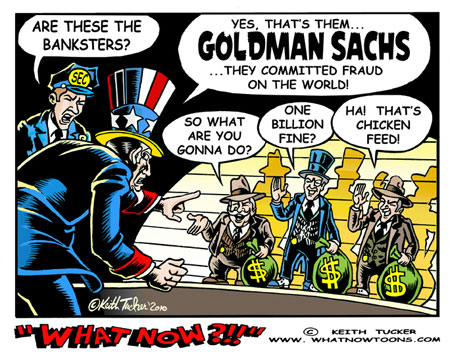

"The simultaneous selling of securities to customers and

short selling them because they

believed they were going to default is the most cynical use of credit

information that I have ever seen." - Sylvain R. Raynes2006

Wall Street brokers

introduces a new index, the ABX, that becomes a way to 'bet' on the value of

mortgage backed securities.

This

index, modeled on the Enron Trading Desk,

allows traders to bet on or against pools of mortgages with different risk

characteristics using variable stock indexes enabling traders to bet on whether

the overall stock market, or technology stocks or bank stocks, will go up or

down.

Goldman Sachs did quite well on the

collapse using the ABX to bet against the housing market.

Wall Street,

with Goldman Sachs leading, inflated

through deception a credit bubble that burst and cost tens of millions of

Americans their jobs, incomes, savings and home equity.

2007

"I continue to be

concerned about the

influence of pooled vehicles in the

marketplace. I see it as

a ticking time bomb that is going to blow at some point." - Securities and

Exchange Commission Chairman William H. Donaldson, May 24, 2007

What is the difference between exchange-traded funds and mutual

funds?

2008

JP Morgan Chase generates $5.6 billion

profit.

Matt Zames, a Long-Term

Capital Management veteran, runs the JP Morgan Chase

derivatives trading desk.

JP Morgan Chase

profits from the collapse of Lehman

Brothers and the takeover of Bear

Stearns.

JP Morgan Chase

dominates derivatives trading - $87.7 trillion worth of outstanding derivatives

contracts as of September 30, 2008.

JP Morgan's

Financial Herpes

"In the last quarter of a century the whole

American economic system has lived off the

speculations generated by

the financial sector - sometimes given the acronym FIRE (for finance,

insurance and real estate). FIRE has grown exponentially while, in the

country's industrial heartland in particular, much of the rest of the economy

has withered away. FIRE carries enormous weight and the capacity to do great

harm." - Steve Fraser 01/08

"The

banks are trying to win back their losses by arbitrage operations,

borrowing from the Federal Reserve at a low interest rate and lending at a

higher one, and gambling on options.

Options and derivatives are

a zero-sum game: one

losses, one gains.

So the banks

collectively are simply painting themselves into a deeper

corner.

They hope they can tell the Federal Reserve and Treasury to

keep bailing them out or else they'll fail and cost the FDIC even more money to

make good on insuring the "bad savings" that have been steered into these bad

debts and bad gambles.

The Federal Reserve and

Treasury certainly seem more

willing to bailout the big

financial institutions than to bailout savers, pensioners, Social Security

recipients and other small fry.

They thus follow the traditional

"Big fish eat little fish" principle of

favoring the vested interests." - Michael Hudson 06/08

March 11,

2009 Jamie Dimon, chief

executive officer of JP

Morgan Chase, said the US government can rescue the financial system by the end

of the year if officials start cooperating and

stop the "vilification" of

corporate America.

"Giant corporations arose early in the last

century followed by wars, depression, and more wars.

Profit-making

oligopolies and monopolies resulted competing not on price but mainly in the

areas of cost-cutting and the sales effort.

Beginning in the late 1960s

and 1970s, financialization came to the rescue, and "to some extent (shifted)

control over the economy from corporate boardrooms to the financial markets.

Corporations were increasingly seen as bundles of assets, the more

liquid the better.

Financialization produced new outlets for surplus in

the FIRE sector (finance,

insurance, and

real estate),

mostly for speculation,

not capital goods investments in plant

and equipment, transportation, and public utilities that earlier

fueled business cycle expansions.

In

the 1970s, it was about one-and-a-half times GDP.

The 1980s saw an

unprecedented upsurge of debt in the economy.

By 1985, it was double,

and by 2005 it was three-and-a-times GDP, rising, and approaching the $44

trillion (level) for the entire world.

Ever since, the way was open for

a proliferation of financial

instruments and markets, which (until the

present) proved to be literally unlimited.

Keynes warned about "enterprise becoming the bubble on a whirlpool of

speculation" like in the 1920s, the price being the

Great Depression.

Bubbles grow

until they burst.

Minor by comparison, the 1997-98 Asian crisis showed

how fast contagion can spread.

Today it's global and

out-of-control.

No one's

sure how to contain it, so bankers are printing trillions in a desperate

attempt to socialize losses,

privatize profits, and pump life back into a corpse

through a sort of shell game or

grandest of grand theft

process of sucking wealth from the public.

Speculation and debt need more of it to

prosper, but in the end it's a losing game." - Stephen Lendman

|

|

|

This web site is not a commercial web site and

is presented for educational purposes only.

This website defines a

new perspective with which to en❡a❡e Яeality to which its

author adheres. The author feels that the faλsification of reaλity

outside personal experience has forged a populace unable to discern

pr☠paganda from reality and that this has been done purposefully by an

internati☣nal c☣rp☣rate

cartel through their agents who wish to foist a corrupt Ѵersion of

Яeality on the human race. Religi☯us int☯lerance ☯ccurs

when any group refuses to tolerate religi☯us practices, religi☸us

beliefs or persons due to their philosophical ideology. This web site marks the

founding of a system of philºsºphy nªmed the Mŷsterŷ

of the Lumière Infinie - a ra☨ional gnos☨ic mys☨ery

re☦igion based on reaso🐍 which requires no leap of faith, accepts

no tithes, has no supreme leader, no church buildings and in which each and

every individual is encouraged to develop a pers∞nal relati∞n with

Æ∞n through the pursuit of the knowλedge of reaλity in

the cu☮ing the spi☮itual co☮☮uption that has enveloped

the human spirit. The tenets of the Mŷsterŷ of the Lumière

Infinie are spelled out in detail on this web site by the author. Vi☬lent

acts against individuals due to their religi☸us beliefs in America is

considered a "hate ¢rime."

This web site in no way

c☬nd☬nes vi☬lence. To the contrary the intent here is to

reduce the vi☬lence that is already occurring due to the

internati☣nal c☣rp☣rate cartels desire to

c✡ntr✡l the human race. The internati☣nal

c☣rp☣rate cartel already controls the w☸rld

ec☸n☸mic system, c☸rp☸rate media w☸rldwide, the

global indus✈rial mili✈ary en✈er✈ainmen✈ complex

and is responsible for the coλλapse of moraλs, the eg●

w●rship behavior and the destruction of gl☭bal ec☭systems.

Civilization is based on coöperation. Coöperation with

bi☣hazards of a gun.

American social mores and values have

declined precipitously over the last century as the internati☣nal

c☣rp☣rate cartel has garnered more and more power. This power rests

in the ability to deceive the p☠pulace in general through

c✡rp✡rate media by press☟ng em☠ti☠nal

butt☠ns which have been πreπrogrammed into the

πoπulation through prior c✡rp✡rate media psychological

operations. The results have been the destruction of the fami♙y and the

destruction of s☠cial structures that do not adhere to the corrupt

internati☭nal elites vision of a perfect world. Through distra¢tion

and coercion the dir⇼ction of th✡ught of the bulk of the

p☠pulati☠n has been direc⇶ed ⇶oward

s↺luti↻ns proposed by the corrupt internati☭nal elite that

further con$olidate$ their p☣wer and which further their purposes.

All views and opinions presented on this web site are the views and

opinions of individual human men and women that, through their writings, showed

the capacity for intelligent, reasonable, rational, insightful and unpopular

☨hough☨. All factual information presented on this web site is

believed to be true and accurate and is presented as originally presented in

print media which may or may not have originally presented the facts

truthfully. Øpinion and

☨hough☨s have been adapted, edited, corrected, redacted, combined,

added to, re-edited and re-corrected as nearly all opinion and

☨hough☨ has been throughout time but has been done so in the spirit

of the original writer with the intent of making his or her

☨hough☨s and opinions clearer and relevant to the reader in the

present time.

Fair Use Notice

This site may contain

copyrighted material the use of which has not always been specifically

authorized by the copyright owner. We are making such material available in our

efforts to advance understanding of ¢riminal justi¢e, human

rightϩ, political, politi¢al, e¢onomi¢,

demo¢rati¢, s¢ientifi¢, and so¢ial justi¢e

iϩϩueϩ, etc. We believe this constitutes a 'fair use' of any

such copyrighted material as provided for in section 107 of the US Copyright

Law. In accordance with Title 17 U.S.C. Section 107, the material on this site

is distributed without profit to those who have expressed a prior interest in

receiving the included information for rėsėarch and ėducational

purposės. For more information see:

www.law.cornell.edu/uscode/17/107.shtml. If you wish to use copyrighted

material from this site for purposes of your own that go beyond 'fair use', you

must obtain permission from the copyright owner. |

Copyright

© Lawrence Turner Copyright

© Lawrence Turner

All Rights Reserved

|