|

wars float financial

bubbles When

new money is printed, its effect is

not felt instantaneously.

The effect moves from a networked individual

to another networked individual and thus from a networked market to another

networked market.

Monetary pumping generates bubble activities across

all market sectors.

When

the bank tightens its monetary stance by reducing monetary pumping bubble

activities are undermined and those bubbles burst.

Since monetary

pumping generates bubble activities across all markets, obviously the eventual

bursting of the bubbles will permeate all markets.

1531 Antwerp

1548

Lyon

1602 Dutch East India Company begins

exchanging stock in Amsterdam.

The first book in history of securities

exchange, the Confusion of Confusions, was written by the Dutch-Jewish

trader Joseph de la Vega and the Amsterdam Stock Exchange is often

considered the oldest “modern” securities market in the

world.

"A Satire of Tulip Mania" by Jan Brueghel the

Younger (ca. 1640)

depicts speculators as brainless monkeys in contemporary

upper-class dress.

tulip mania bubble February 1637 At the peak of tulip mania

tulip futures contracts are selling for more

than 10 times the annual income of a skilled craftsman.

Tulip mania or

tulipomania (Dutch: tulpenmanie, tulpomanie, tulpenwoede, tulpengekte, and

bollengekte) was a period in the Dutch Golden Age during which contract prices

for bulbs of the recently introduced tulip reached extraordinarily high levels

and then suddenly collapsed.

The Mosaic virus created beautifully

varigated blooms spread only through buds, not seeds, and so cultivating the

most appealing varieties takes years.

But propagation is greatly slowed

down by the Mosaic virus.

Tulips bloom in April and May for only about

a week, and the secondary buds appear shortly thereafter.

Bulbs can be

uprooted and moved about from June to September, and thus actual purchases (in

the spot market) occurred during these months.

During the rest of the

year, traders signed futures

contracts before a notary to purchase tulips at the end of the

season.

The futures contract

promises to guarantee

delivery of specificied assets, in this case tulip bulbs, on a specific

date for an agreed upon fixed price.

Short selling is banned by an edict of 1610,

which is reiterated or strengthened in 1621 and 1630, and again in

1636.

Short sellers were not prosecuted

under these edicts, but their contracts are deemed unenforceable.

1636 Dutch create a type of formal

futures market where contracts to buy

bulbs at the end of the season are bought and sold.

Traders met in

"colleges" at taverns and buyers were required to pay a 2.5% "wine money" fee,

up to a maximum of three florins, per trade.

Neither party paid an

initial margin nor a mark-to-market margin, and all

contracts were with individual counterparties rather than the exchange.

No deliveries were ever made to fulfill these contracts because of the

market collapse in February 1637.

On February 24, 1637, the

self-regulating guild of

Dutch florists, in a decision that

was later ratified by the Dutch Parliament, announced that all futures

contracts written after November 30, 1636 and before the re-opening of the cash

market in the early Spring, were to be interpreted as

call option contracts,

or options to purchase in the

future.

This change of law was done at the behest of major Dutch

tulip investors who were trying to recoup lost money because of a German

setback in the

Thirty Years' War.

They simply relieved the futures

purchaser of the requirment to purchase if they paid a small fixed percentage

of the contract price as a default on the failure to purchase.

An option

contract purchases the right to buy an asset at a date in the future at an

agreed upon price.

This trade was centered in Haarlem during the height

of a bubonic plague epidemic, which

may have contributed to a culture of fatalistic risk taking.

the Mississippi bubble

"Imagine the following: a collection of debts owed

by a highly leveraged borrower with

a bad credit record is magically transformed into

marketable securities with triple-A yields.

How is this miracle performed?

It is through the power of

financial innovation and free capital markets!

It could be the story of

subprime mortgages in the US; but it is not.

It is the story of government debt in France in the early 18th century.

In 1719-20, a

financial whirlwind swept through France.

Shares in the Compagnie

d'Occident, or the Mississippi Company, rose 1,000 per cent and then fell by 90

per cent in less than two years.

The story illuminates current events."

- James Macdonald, Financial Times (London) March 6, 2008 HOW THE FRENCH INVENTED SUBPRIME IN

1719

By the end of the War of Spanish

Succession in 1714 public debt had risen to over 100 per cent of national

income and was subjected to forced reductions of interest and principal.

Confidence collapsed.

Government bonds sold for discounts of up

to 75 per cent.

Louis XIV, the "Sun King," had consolidated French

power in Europe but the Nine Year War and the War of Spanish Succession had

effectively bankrupt France by 1715 the year of Louis XIV's death.

France defaulted on its debt, high taxes burdened the country and the

value of gold and silver currency fluctuated wildly.

Louis XV turned to

the Duke of Orleans who hired John Law, a Scottish adventurer, economic

theorist, and financial wizard/engineer.

The

charismatic John Law

lived by his wits at the gambling table

and had never held any post related to public finance.

The government

would issue a new series of bonds, paying only 3 per cent in exchange for its

old debts which paid 4-5 per cent, in exchange for shares in the Mississippi

Trading Company, which held monopoly trading rights to the French colonies.

For the government, the cost of servicing the debt would fall sharply

and the budget would look rosier.

The trading rights to the French

colonies were largely worthless, for there were no profits at the time and the

Mississippi Company had existed for a while without exciting public

interest.

The market for government debts was moribund.

John

Law's aim was to make Mississippi shares as actively traded as

possible.

This provided an incentive to swap - to get a more liquid

security and the prospect of speculative gains.

John Law repackaged a

collection of "subprime" debts as marketable securities under a different name

and thereby increased their investor appeal.

Law claimed that

Mississippi shares would be so actively traded that they would constitute "a

new form of money."

For this governmnet debt reduction plan to succeed

a new bank must be founded to provide a massive monetary stimulus of easy money

to get bond holding creditors to convert government bonds into Mississippi

trading company shares.

1716 John Law established the

Banque Générale, a bank with the

authority to issue

fiat bank notes.

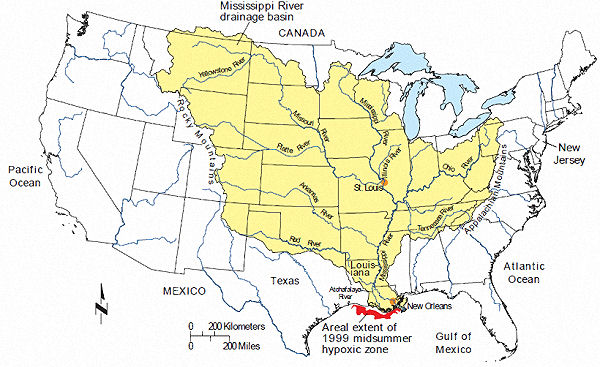

In 1717 John

Law established the Compagnie d'Occident ("Company of the West") and

obtained a 25-year monopoly to develop the vast French territories in the

Mississippi River valley of North America.

Compagnie d'Occident

soon monopolized the French tobacco and African slave trade, and by 1719 the Compagnie des

Indes ("Company of the Indies"), as it had been rebranded, held

a complete monopoly

of France's colonial trade.

John Law took over the collection of French

taxes and the minting of money.

In effect, John Law controlled both the

country's foreign trade and its finances.

An effective marketing

scheme was developed describing the Compagnie des Indes as a future

profit generator due to its monopolistic controls of the exaggerated wealth of

Louisiana.

This marketing scheme sent the price for a share from 500 to

10,000 livres , completely out of all proportion to earnings.

The debt

was exchanged and became worth many times its previous value as Mississippi

shares continued their dizzying

ascent.

The economy recovered and

everyone was happy - even

though the underlying reality was

an unsustainable

credit-driven boom.

1719 John Law had issued

approximately 625,000 stock shares, and he soon afterward merged the Banque

Générale with the Compagnie des Indes.

The

Compagnie bought the right to collect all French indirect taxes, took

over the collection of direct taxes, purchased the right to mint new coinage.

The center piece of this financial plan was the retirement of Louis

XIV's debt.

Shares of the Compagnie des Indes were exchanged for

state-issued public securities, or billets d'état, which consequently

also rose sharply in value.

The French government debt, 1,000% of the

annual budget, became property of the Compagnie des Indes.

The

French government takes advantage of this situation by printing increased

amounts of paper money, which was readily accepted by the state's creditors

because it could be used to buy more shares of the Compagnie.

The underlying assets of the Mississippi Company were still

questionable royal debts that did not provide enough income to pay its promised

dividends.

Excessive issue of paper

money stimulated galloping inflation, and both the

paper money and the billets

d'état began to lose their value.

Moreover, like many

holders of collateralized debt obligations,

speculators in Paris relied heavily on borrowed money.

The rise in

Mississippi shares is reversed.

Shareholders find themselves holding

toxic debt.

1720 The value of the

shares of the Compagnie plummeted, causing a general stock market crash

in France and other countries.

Financial engineer John Law is

forced to flee France.

The

debts of his company and bank were consolidated and made good by the state

which raised taxes in order to retire the debt.

South Sea

bubble 1711

South Sea Company, a joint stock incorporation is granted a monopoly to

trade in the South American colonial possessions of

Spain as part of a treaty during the War

of Spanish Succession.

The South Sea Company assumes the

bonded debt England incurred

during the war in return for the monoploy.

The

primary trading business of the

South Sea Company was transporting slaves from

Africa to America.

South Sea Company proposed a scheme by which it

would assume half the bonded

debt of Britain (£30,981,712) with new shares and

contractually promises to the

government that the debt will be converted to a lower interest rate, 5%

until 1727 and 4% per year thereafter.

The purpose of this is to

allow a conversion of high-interest

bonded debt into low-interest marketable debt as shares of the South Sea

Company.

The South Sea Company market the stock with "the most

extravagant rumours" of the value of its potential trade in the New

World.

A frenzy of wild

speculation ensues leading to the South Sea Bubble.

1720 The share price rises from £128 in January to

£890 in early June even though trade with Spanish colonies is limited to

one ship carrying not more than 500 tons of cargo and the slave trade.

When the speculative adventure collapsed the estates of the directors

of the incorporation are confiscated and used to repay some creditors, and the

stock of the South Sea Company is divided between the major creditors -

the Bank of England and British East India

Company.

In summation all

three of these speculative run-ups in the value of tulip bulbs or 'stock' was

caused directly by war.

Tulip investors were trying to recoup loses

from betting on Germany winning the Thirty Years War while both the South Sea

and Mississippi bubbles were designed to retire onerous government debt due

primarily to the expenses involved in the War of Spanish Succession.

|

|

|

This web site is not a commercial web site and

is presented for educational

purposes only.

This website defines a

new perspective with which to en❡a❡e Яeality to which its author adheres. The

author feels that the faλsification of reaλity outside personal

experience has forged a populace unable to

discern pr☠paganda

from Яeality and that this has been done purposefully by an

internati☣nal c☣rp☣rate

cartel through their agents who wish to foist a corrupt version of

reaλity on the human race. Religious intolerance occurs

when any group refuses to tolerate religi☯us practices, religious beliefs

or persons due to their religi⚛us ide⚛l⚛gy. This web site

marks the founding of a system of philºsºphy nªmed the

Mŷsterŷ of the Lumière Infinie - a ra☨ional

gnos☨ic mys☨ery re☦igion based on reaso🐍 which

requires no leap of faith, accepts no tithes, has no supreme leader, no church

buildings and in which each and every individual is encouraged to develop a

pers∞nal relati∞n with the Æon through the pursuit of the

knowλedge of reaλity in the cu☮ing the spi☮itual

co☮☮uption that has enveloped the human spirit. The tenets of the

Mŷsterŷ of the Lumière Infinie are spelled out in detail on

this web site by the author. Vi☬lent acts against individuals due to

their religi☸us beliefs in America is considered a "hate

¢rime."

This web site in no way condones violence. To the contrary

the intent here is to reduce the vi☬lence that is already occurring due

to the internati☣nal c☣rp☣rate cartels

desire to control the human

race. The internati☣nal c☣rp☣rate cartel already controls

the world economic system, c☸rp☸rate media w☸rldwide, the

global industrial military entertainment complex and is responsible for the

coλλapse of moraλs, the eg●

w●rship and the destruction of

gl☭bal ec☭systems. Civilization is based on coöperation.

Coöperation with bi☣hazards at

the point of a

gun.

American social mores and values have declined precipitously

over the last century as the internati☣nal c☣rp☣rate cartel

has garnered more and more power. This power rests in the ability to deceive

the p☠pulace in general through c✡rp✡rate media by

press☟ng em☠ti☠nal butt☠ns which have been

πreπrogrammed into the πoπulation through prior mass media

psychological operations. The results have been the destruction of the

fami♙y and the destruction of s☠cial structures that do not adhere

to the corrupt internati☭nal elites vision of a perfect world. Through

distra˘tion and ˘oer˘ion the dir⇼ction of th✡ught of the bulk of the

p☠pulati☠n has been direc⇶ed ⇶oward s↺luti↻ns proposed by the

corrupt internati☭nal elite that further con$olidate$ their p☣wer

and which further their purposes.

All views and opinions presented on

this web site are the views and opinions of individual human men and women

that, through their writings, showed the capacity for intelligent, reasonable,

rational, insightful and unpopular ☨hough☨. All factual information presented

on this web site is believed to be true and accurate and is presented as

originally presented in print media which may or may not have originally

presented the facts truthfully.

Øpinion and ☨hough☨s

have been adapted, edited, corrected, redacted, combined, added to, re-edited

and re-corrected as nearly all opinion and ☨hough☨ has been throughout time but

has been done so in the spirit of the original writer with the intent of making

his or her ☨hough☨s and opinions clearer and relevant to the reader in the

present time.

Fair Use Notice

This site may contain

copyrighted material the use of which has not always been specifically

authorized by the copyright owner. We are making such material available in our

efforts to advance understanding of ¢riminal justi¢e, human

rightϩ, political, politi¢al, e¢onomi¢,

demo¢rati¢, s¢ientifi¢, and so¢ial justi¢e

iϩϩueϩ, etc. We believe this constitutes a 'fair use' of any

such copyrighted material as provided for in section 107 of the US Copyright

Law. In accordance with Title 17 U.S.C. Section 107, the material on this site

is distributed without profit to those who have expressed a prior interest in

receiving the included information for rėsėarch and ėducational

purposės. For more information see:

www.law.cornell.edu/uscode/17/107.shtml. If you wish to use copyrighted

material from this site for purposes of your own that go beyond 'fair use', you

must obtain permission from the copyright owner. |

Copyright

© Lawrence Turner Copyright

© Lawrence Turner

All Rights Reserved

|