|

During the Pujo Money

Trust investigation Samuel Untermeyer

personally cross examines JP

Morgan and other Wall Street

investment bankers.

The Pujo Money Trust Committee

concludes:

Panic of 1907

started with the closing of the Knickerbocker Trust when

its clearing bank, National Bank of

Commerce, refuses to act as its clearing agent any longer:

-

clearing house associations are discriminating via capital requirements as well

as predatory membership and

discriminatory member

policies.

- predatory listing practices are forcing restrictions on

both members and non-members of the New York Stock Exchange as well

as "unwholesome speculation" and

price manipulation by large groups

colluding for profit.

- consolidation of banks and interlocking

directorates (small group of men serving as directors on several boards) has

led to acumulation of wealth concentrating 42.9% of

banking resources into the twenty largest banks.

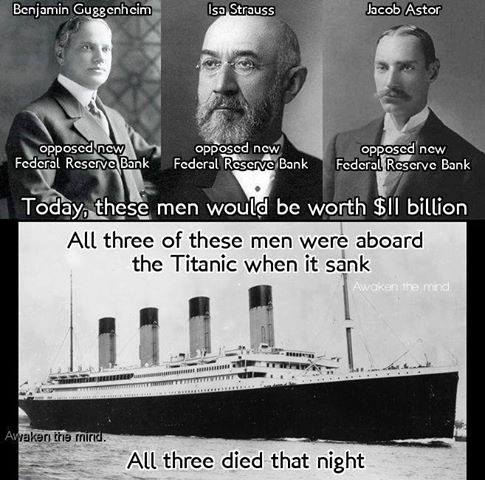

Investigators found

that 180 individuals in 341 directorship positions

in 112 corporations with $22,245,000,000 in aggregate resources of

capitalization.

At least 18 different major

financial corporations were under the control of a cartel led by

John P. Morgan,

George Fisher Baker and

James

Stillman.

At the turn of the century, these three men, through the

resources of seven banks and trust companies (Bankers Trust,

Guaranty Trust, Astor Trust,

National

Bank of Commerce, Liberty National Bank, Chase National Bank,

Farmer's Loan and Trust) control an estimated $2.1 billion.

The

report reveals that a handful of men hold manipulative control of the New

York Stock Exchange.

The Pujo Report singles

out Paul Warburg, Jacob Hirsch

Schiff, Felix

Warburg, Frank E.

Peabody, William Avery Rockefeller Jr. and Benjamin Strong - the

Money

Trust.

Pujo Committee Abandons Hope of Getting Financier to

Testify

Few know that the Tsars of Russia continually opposed a

central bank in Russia and supported

Abraham Lincoln

during the Civil War.

The

US-Russian Alliance that Saved the Union

1911

Corporations begin to finance

expansion out of profits instead of borrowing.

In the first 10 years of

the 20th century, 70% of corporate funding comes from profits.

Samuel Untermeyer delivers

the speech "Is There a Money Trust?"

Charles A. Lindbergh asserts

the banking trust should be investigated.

An 'educational' fund of

$5,000,000 is set up to finance academics at top

universities to endorse the new central banking plan.

The newly

chartered central bank, modeled on the

Bank of North

America, given a monopoly over US currency to

create money without collateral.

In order to persuade the public

consciousness the "new" central banking system is under control of the US

government, the plan calls for the central bank to be run by a Board of

Governors appointed by the President and approved by the Senate.

"When

that monetary bill was given to the country, it was but a few days previous to

the meeting of the American Bankers

Association in New Orleans in 1911. There was not one banker in a

hundred who had read that bill. We had twelve addresses in favor of it." -

Andrew Frame 1911

1912 The Aldrich Bill is

presented to Congress for debate and quickly identified as a bill to benefit

private central bankers.

"The Aldrich Plan is the Wall Street Plan. It

means panic, if necessary, to intimidate

the people.

Aldrich, paid by the government to represent the people, proposes a plan for

the trusts instead." - Charles A. Lindbergh

"Under the Aldrich Plan the

bankers are to have local associations and district associations, and when you

have a local organization, central control is assured.

When you have hooked the banks together, they can have the biggest influence of

anything in this country, with the exception of the

newspapers." - Leslie

Shaw

Republican leadership schism never brings the Aldrich Bill to a

vote.

During the

Democratic

presidential campaign, Woodrow Wilson and the

leadership of the Democratic Party pretend to oppose the Aldrich Bill.

"The Aldrich Bill was condemned in the platform of Woodrow Wilson.

The men who ruled the Democratic Party promised

the people that if they were

returned to power there would be no central bank established here.

Thirteen months later that promise was

broken, Woodrow Wilson, under the tutelage of sinister Wall Street figures

who stood behind Edward Mandell

House, established in our free country

the worm-eaten monarchical

institution of the, 'King'

Bank,' to control us

from the top downward,

and to shackle us from the cradle to the

grave." - Louis T. McFadden

"We object to the Aldrich Bill on

the following points:

Lack of adequate government or public control of

the mechanism it sets up.

Puts voting control into the hands of the

large banks of the system.

The extreme danger of inflation of currency

inherent in the system.

The insincerity of the bond funding plan

provided for by there being a barefaced pretense that this system is to cost

the government nothing.

The dangerous monopolistic aspects of the bill."

- Carter Glass

Big money is turning its

back on companies that aren't conforming to one simple idea…

Sustainability.

It's fueling one of the biggest transfers of capital

the world has ever seen.

BlackRock, with over $7 trillion in assets

under management, says its clients will double investments in just five

years…

Money managers on the Street are saying

climate change is their top

concern…

Sustainable assets already account for $17.1

trillion…

But there could be as much as $120 trillion up for

grabs. |

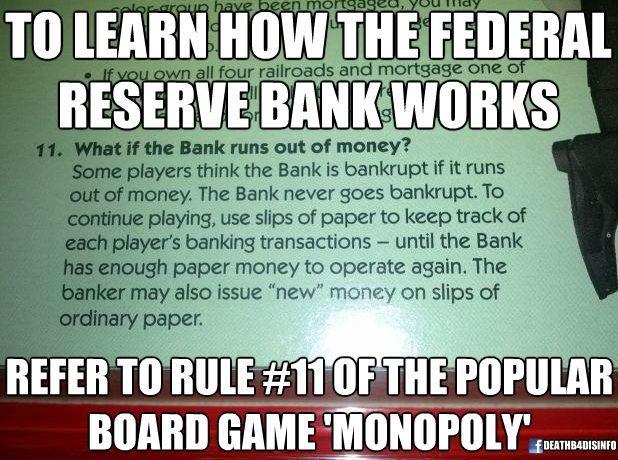

"The Federal Reserve was intended to promote price

stability, prevent financial

panics and smooth out the amplitude of the business cycle.

Ironically, and unbeknownst to most Americans, Federal Reserve policy

is enormously responsible for the boom-and-bust economic metric.

Interest rate reductions, money supply manipulation, currency

intervention, and interference in the private sector are not the marks of a

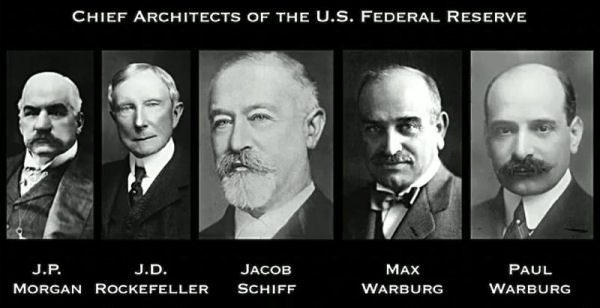

free-market economy." - Drew Klein 04/08 1913 Paul

Warburg and Bernard

Mannes Baruch advance a new monetary system Paul Warburg calls the Federal

Reserve system.

The leadership of the Democratic Party hail this new

bill, the "Glass-Owen" bill, as totally different to the Aldrich Bill, when it

is virtually identical.

"Without Paul Warburg there would have been no

Federal Reserve Act.

The banking

house of Warburg and

Warburg in Hamburg has always been strictly a family business.

None but a Warburg has been eligible for it, but all have been born

into it.

In 1895 Paul Warburg married the daughter of the late Solomon Loeb of Kuhn, Loeb &

Company. Paul Warburg became a member of Kuhn, Loeb & Company in

1902." - Harold Kelloch

"Paul Warburg is the man who got the Federal Reserve Act together

after the Aldrich Plan aroused nationwide resentment and

opposition.

The mastermind of both plans was

Baron Alfred de

Rothschild of London." - Col. Garrison, an agent of Brown

Brothers

"Brushing aside the external differences affecting the,

'shells,' we find the, 'kernals,' of the two systems very closely resembling

and related to one another." - Paul Warburg

Nelson Wilmarth Aldrich, and

Frank Vanderlip of National City

Bank, publicly state their opposition to the bill in order to make

people believe that the bill proposed is radically different from the Aldrich

Bill.

"Although the Aldrich Federal Reserve Plan was defeated when it

bore the name Aldrich, nevertheless its essential points were all contained in

the plan that finally was adopted." - Frank Vanderlip, Saturday Evening

Post

"Congress should go slow on currency legislation. The recent

artificial panic was to scare

the country into forcing Congress to act quickly and blindly.

They are

unwilling to have a people's government."- Alfred Owen Crozier

With Congress near a vote on the Glass-Owen Alfred Crozier

testified:

"The bill should prohibit the granting or calling in of loans

for the purpose of influencing quotation prices of securities and

contracting of loans or

increasing interest rates in concert

by the banks to influence public opinion or action of any legislative body.

The administration' currency bill grants what Wall Street and the big

banks, for twenty-five years have been striving for -

private control of currency.

It does

this as completely as the Aldrich Bill.

Both proposals

rob the people and the

government of effective control over public money, and vest in the banks

exclusively the dangerous power to make money among the people scarce or

plenty.

The Aldrich Bill puts this power in one central bank.

The Administration Bill puts it in twelve regional central bank, all

owned exclusively by identical private interests that would have owned and

operated the Aldrich Bank.

President Garfield,

before his assassination declared, whoever controls the supply of currency

would control the business and activities of the people." - Alfred Crozier

1913

October

Congress passes a bill, authored by Nelson Wilmarth Aldrich,

legalizing a direct income tax of the

people - the 16th amendment.

The

income tax law is

fundamental to the Federal Reserve system as

US treasury bond debt needs

a source of income to retire that

debt.

The only way to guarantee payment of interest is to

directly tax the

people.

If the Fed had to rely on contributions from the States

(like the UN), it would be dealing with bigger entities, who could revolt and

refuse to pay interest.

According to Bill Benson

the 16th amendment was never legally ratified .

December 19 Senate passed a version by a vote of 54-34. Over forty

important differences in the House and Senate versions remain to be settled.

"The bill opens the way to a

vast inflation of currency. I do not like to think a law can be passed

which will make it possible to sink the

Gold

Standard in a flood

of irredeemable paper currency." - Henry Cabot Lodge Sr.

Opponents

of the bill in both houses of Congress are led to believe many weeks would

elapse before the the Federal Reserve Act conference bill would be ready for

consideration and left town to enjoy Christmas with family.

December 22 Federal Reserve Act is passed by the House 282-60

and the Senate 43-23.

"Centralization of credit in the banks of the

state, by means of a

national bank with state capital and

an exclusive

monopoly."

Point 5 Communist Manifesto,

Karl Heinrich

Marx

December 23,

1913

Woodrow Wilson signs the Federal

Reserve Act..

A comparative print of the Federal Reserve Act

as passed by the House of Representatives and amended by the Senate shows the

following change:

The Senate struck out, "To suspend the officials of

Federal Reserve banks for cause, stated in writing with opportunity of hearing,

require the removal of said official for incompetency, dereliction of duty,

fraud or deceit, such removal to be subject to approval by the President of the

United States."

Changed by the Senate to read "To suspend or remove any officer or director of

any Federal Reserve bank, the cause of such removal to be forthwith

communicated in writing by the Federal Reserve Board to the removed officer or

director and to said bank."

Changed by the Senate to read "To suspend or remove any officer or director of

any Federal Reserve bank, the cause of such removal to be forthwith

communicated in writing by the Federal Reserve Board to the removed officer or

director and to said bank."

The signing of the Federal Reserve Act by

Woodrow Wilson represents the culmination of years of

collusion betwwwn intimate friends, Edward Mandell House, Bernard Mannes

Baruch, Paul Warburg, et al.

"This Act establishes the

most gigantic trust on earth. When

the President signs this bill, the invisible government of the monetary power

will be legalized." - Charles A Lindbergh Sr.

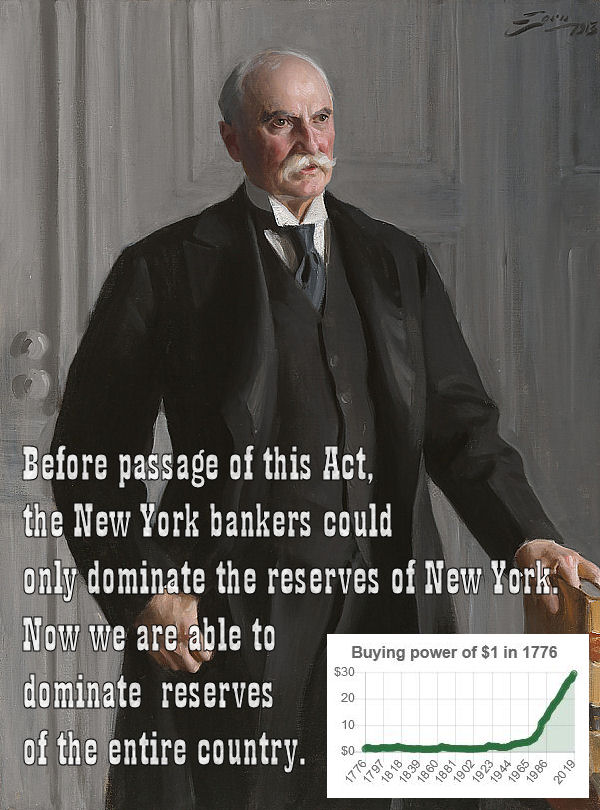

$1 in 1776 = $29.44 in 2019

$20.00 in 1776

= $588.80 in 2019

December 24 Jacob Hirsch Schiff to Edward Mandell

House:

"My dear Colonel House. I want to say a word to you for the

silent, but no doubt effective work you have done in the interest of currency

legislation and to congratulate you that the measure has finally been enacted

into law. I am with good wishes, faithfully yours, Jacob

Schiff."

"The first task of the

Federal Reserve would be to finance the World War.

The European nations

were already bankrupt, because they

had maintained large

standing armies for almost fifty years, a situation made by their own

central banks, and therefore they could not finance a war.

A central

bank always imposes a

tremendous burden on the nation for "rearmament" and "defense", in order to

create inextinguishable debt, simultaneously creating

a military dictatorship

and enslaving the people to pay the "interest" on the debt which the bankers

have artificially created." - Eustice Mullins

"Before passage of this

Act, the New York bankers could only dominate the reserves of New York. Now we

are able to dominate bank reserves of the entire country." -

Nelson

Wilmarth Aldrich

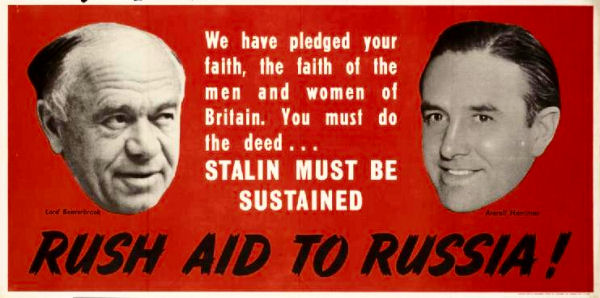

1914 At the start of World

War I the German Rothschilds

loan money to the Germans, the British Rothschilds loan money

to the British, and the French

Rothschilds loan money to the French while the Federal Reserve

provides liquidity with cash

infusions.

"To

cause high prices, all the Federal Reserve Board will do will be to lower the

rediscount rate, producing an expansion of credit and a rising stock market,

then when business men are adjusted to these conditions, it can check

prosperity in

mid-career by arbitrarily raising the rate of interest.

It can cause

the pendulum of a rising and falling market to swing gently back and forth by

slight changes in the discount rate, or cause violent fluctuations by a greater

rate variation, and in either case it will possess

inside information as to financial

conditions and advance knowledge of the coming change, either up or down.

Inflation and

deflation work equally well." - Charles A Lindbergh Sr.

Federal Reserve banks

began operations on November 16 with total assets listed at $143,000,000

garnered from the sale of shares in the Federal Reserve banks to stockholders

of the national banks which subscribe.

It seems most likely that

from the very outset, the Federal Reserve operations were "paper issued against

paper": fungible bookkeeping

entries in a ledger comprised the only values which actually "changed

hands."

The stock in the original twelve regional Federal Reserve banks

is purchased by national banks in the twelve regions:

Boston,

New York,

Philadelphia,

Cleveland, Richmond, Atlanta, Chicago,

St. Louis, Minneapolis, Kansas

City, Dallas and San Francisco.

The Federal Reserve Bank of New York

sets the interest rates and

directs open market

operations, controlling the daily supply and value of money.

Each

member bank of the Federal Reserve system owns nonnegotiable shares of stock in

its regional Federal Reserve Bank.

A 6% dividend is paid on the stock

to member banks which are all privately owned and operated.

Federal

Reserve Board of Governors must approve Federal Regional Bank

presidents.

1916

Max Warburg opens an account by

cable at (Rothschilds) Nya Banken in Stockholm, Sweden for

Leon Trotsky.

1917

Woodrow Wilson calls for war on Germany.

With the entry of the US into

the World War I, Julius H. Barnes, a

grain salesman, and Prentiss Gray,

a lumber shipping clerk, are

given important posts in the new US Food Administration under Herbert

Hoover.

Julius H. Barnes became President of the Grain

Corporation and Prentiss Gray becopmes chief of Marine

Transportation.

G. A. Zabriskie, is named head of the US Sugar

Equalization Board.

All three - Julius H. Barnes, G. A. Zabriskie,

Prentiss Gray - are agents for J. Henry Schröder Banking

Corporation in New York

After the World War I, the partners of J.

Henry Schröder owned most of Cuba's sugar industry.

ME Rionda

was president of Cuba

Cane, director of Manati Sugar and American British and Continental

Corporation, and other firms.

Kurt Freiherr von

Schröder, senior partner of the firm, is a director of North

British and Mercantile Insurance Company and also a director of Sao Paulo Coffee, the largest

Brazilian coffee companies, with F.C. Tiarksr.

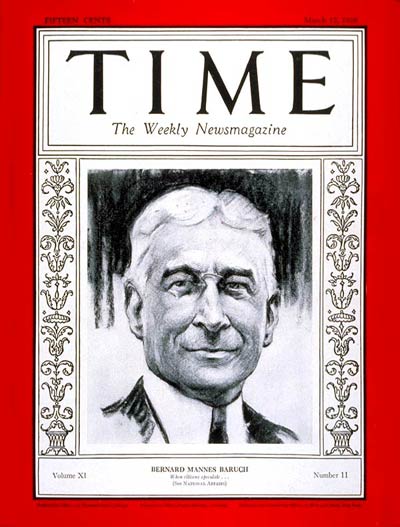

March 4, 1918 Woodrow Wilson appoints Bernard Baruch chairman

of the War Industries

Board.

According to historian, James Perloff, Bernard Baruch

profited by approximately 200 million dollars during World War I.

"If

one understands that socialism is not a

share-the-wealth

program, but it is in reality a method to consolidate and control

the wealth, then the seeming

paradox of super-rich men

promoting socialism becomes no paradox at all.

Instead it becomes

logical, the perfect tool of power seeking meglomaniacs.

Communism, or more

accurately socialism, is not a movement of the downtrodden masses, but of the

economic elite." - Gary Allen

1919

Paris Peace

Conference takes place at the end of World War I.

"No country

can afford to have its prosperity originated by a small controlling class." -

Woodrow Wilson

"Half a dozen men at the top of

the Big Five Banks could upset the whole

fabric of government finance by refraining from renewing Treasury Bills." -

London Financial Times 1921

"If our nation can issue a dollar bond, it can

issue a dollar bill.

The element that makes the bond good, makes

the bill good.

It is

absurd to say that our country can issue 30 million dollars in bonds and

not 30 million dollars in currency.

Both are promises to pay, but one

promise fattens the usurers and the other helps the people." -

Thomas Edison, December

6, 1921 New York

Times

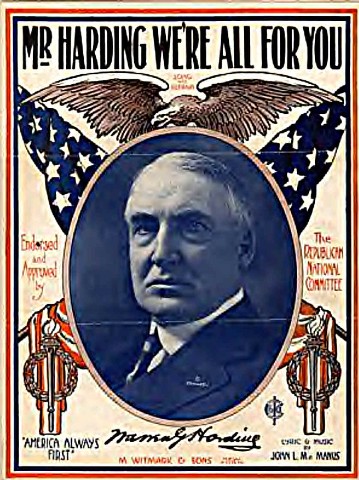

1921 Warren G. Harding is selected

President of the United States, and succeeds Woodrow Wilson.

This

begins the period which becomes known as the, "Roaring Twenties."

Despite the fact that World War I had saddled America with debt ten

times larger than the Civil War debt, the US economy grows.

Andrew William Mellon is

Secretary of the Treasury.

Gold pours

into America during the war and continues to during the 1920's.

Warren G. Harding reduced taxes

domestically, and increased tariffs on

imports to record levels.

"The warning of

Theodore Roosevelt

has much timeliness today, for the

real menace of our republic is this

invisible government which

like a giant octopus sprawls its slimy length over city, state, and nation.

It seizes in powerful

tentacles executive

officers, legislative

bodies, schools,

courts,

newspapers, and

every agency created for the

public protection.

To depart from mere generalizations, let me say

that at the head of this

octopus are the Rockefeller-Standard Oil interest

and a small group of powerful

banking houses generally referred to as international bankers.

They

practically control both parties,

write political platforms,

make catspaws of party

leaders, use the leading men of private organizations, and resort to every

device to place in nomination for high public office only such candidates as

will be amenable to the dictates of corrupt big business.

These

international bankers

and Rockefeller-Standard Oil interests control the majority of newspapers and

magazines in this country." - John Hylan, Mayor of New York, March 26, 1922

New York Times

"The Jews are responsible for Bolshevism in Russia, and Germany

too.

I was far too indulgent with them during my reign, and I bitterly

regret the favors I showed the prominent Jewish bankers."- German Kaiser

Wilhelm II Chicago

Tribune July 2, 1922

1923 Warren G.

Harding dies under mysterious circumstances.

Appearances suggest food

poisoning or a stroke - no autopsy is performed.

Warren G. Harding is

succeeded by his Vice-President Calvin Coolidge.

Calvin Coolidge continues the tax

cutting and tariff raising

policies.

This policy is so successful the economy continues to

grow, and the huge Federal debt built up during World War I, is reduced by

38%.

Federal Reserve begins increasing the money supply by

62%.

1927

Bank of England Governor Montagu Norman,

Benjamin Strong of the Federal Reserve

Bank of New York, and

Hjalmar Schacht of

the Reichsbank, meet in conference.

Federal Reserve bails out the Bank

of England by increasing the money supply through cheap

loans.

These cheap loans are used to purchase stock on margin sending

the gold flowing back into the coffers of the

Bank of England by

reducing the value of the American dollar in relation to the British

pound(£).

"I think it can hardly be disputed that the

statesmen and financiers of Europe are ready to take almost any means to

reacquire rapidly the gold stock which Europe lost to America as a result of

World War I." - Louis T.

McFadden, February 1931

"In the 1920s, the US experienced a

stock market boom as the commercial banks provided funds for the purchase of

stock using the latter as collateral, creating

a massive wave of

underwriting and purchasing of securities.

The stock market

speculation that followed was the result of the banks borrowing substantially

from the Federal Reserve. The Federal Reserve System financed the great stock

market boom." - Andrew Gavin Marshall

1929

Andrew William Mellon, Herbert

Hoover's Secretary of the Treasury, spent much of the time overseas between

1929-31 purportedly negotiating for repayment of European war debts from World

War I.

Mellon served as a director of the Pittsburgh National Bank

of Commerce.

Mellon advises

Herbert Hoover:

"Liquidate labor,

liquidate stocks,

liquidate farmers,

liquidate real estate, it

will purge the rottenness

out of the system. High costs of living and high living will come down.

People will work harder, live a more moral life. Values will be adjusted, and

enterprising people will pick up from less competent people."

Mellon is

the 3rd wealthiest man in America after Rockefeller and

Ford.

Paul Warburg

sends out a warning that a collapse and

nationwide depression are

set in motion for later that year.

In August the Federal Reserve begins

to tighten the money supply.

On 24th October

New York bankers call in their 24 hour broker call loans.

"The New

York financiers started calling 24 hour broker call loans.

This meant

that the stockbrokers and the customers had to dump their stock on the market

in order to pay the loans.

This naturally collapsed the stock market

and brought a banking collapse because the banks not owned by the oligarchy were

heavily involved in broker call claims and bank runs soon exhausted their coin

and currency.

The Federal Reserve system would

not come to their aid, although they were instructed by law to

maintain an elastic currency." -

William Jennings Bryan

"At the height of the

selling frenzy Bernard Mannes Baruch brought

Winston Churchill into the

visitors gallery of the New York

Stock Exchange to witness the panic and impress him with his power over

the wild events on the floor." - John Kenneth Galbraith, The

Great Crash 1929

"Actually, it was the calculated 'shearing' of the

public by the Money Power

triggered by the planned sudden shortage of call money in the New York Money

Market." - Curtis B. Dall

Curtis B. Dall, son-in-law of

Franklin D

Roosevelt, was a Lehman Brothers broker

on the floor of the New York Stock

Exchange on the day of the crash.

"Those who controlled private

capital largely walked away from the US economy for the entire 1930s, refusing

to pump in enough new investment even to replace the machinery and

goods-in-process that were consumed during the

decade." - Robert P. Murphy

1931

Brown Brothers merges with

two other business entities, Harriman Brothers and WA Harriman.

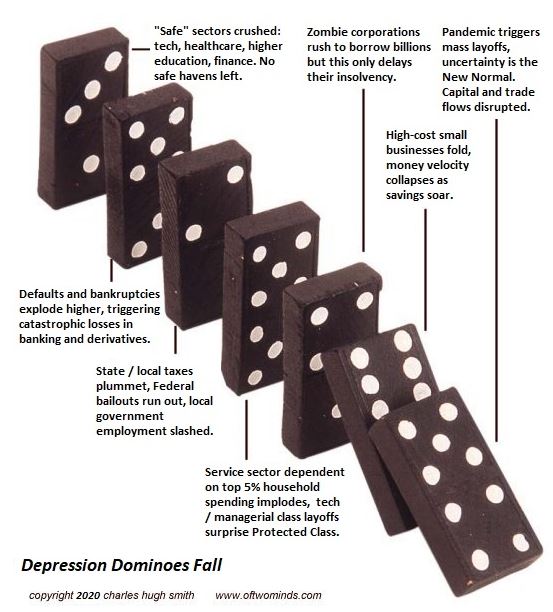

1929 to 1933 Despite claims of the Federal Reserve protecting

the country against depressions and inflation, the

money supply is reduced by an

additional 33%.

"The Federal Reserve definitely caused the

Great Depression by

contracting the amount of currency in circulation by one-third from 1929 to

1933." - Milton Friedman, radio interview January 1996

In only a few

weeks from the day of the crash, 3 billion dollars of wealth vanished.

Within a year, 40 billion dollars of wealth vanish.

It did not

disappear, it just ended up consolidated in fewer and fewer

hands.

Emergency Banking Act of March 9,

1933

"The Federal Reserve Board has

pumped so many millions of

dollars into Germany that they dare not name the total." - Louis T.

McFadden, Chairman House Banking & Currency Committee

General

Motors, General Electric,

DuPont were intimately

related to the growth of the Nazi

war armaments industry and profited handsomely.

The money pumped

into Germany for World War II, was pumped into German banks affiliated with the

Harriman interest in New

York.

1989

Representative Henry Gonzalez, of Texas, introduces House Resolution 1469,

calling for the abolition of the Fed

Open Market Committee of the Federal Reserve system.

He also

introduced House Resolution 1470, calling for the repeal of the Federal Reserve

Act of 1913.

During the same session, Representative Phil Crane of

Illinois, introduced H.R. 70, calls for an annual audit of the Federal Reserve.

These efforts fail.

Americans are told to believe that the

deaths of Senator John Heinz

(outspoken Vietnam War critic),

Senator John Tower (investigated

the Reagan/Bush era Iran-Contra scandal) and

Senator Paul

Wellstone (against repeal of Glass-Steagall) in separate airplane

crashes were "coincidence."

1991 "John Tower had been an outspoken critic of the

Establishment.

John Tower had a very strong sense of

right and wrong,

particularly on matters concerning

national

security.

He was well known for "bucking" the tide.

This

backfired on him with deadly results when certain members of Congress, loyal to

the Reagan and

Bush faction of the Intelligence

Community, banded together against him in a smear campaign which resulted

in the denial of Tower's confirmation as Secretary of Defense.

Outraged

over the undocumented allegation made to slander his name, Tower began the book

writing process so feared in Washington circles.

His controversial book

heavily criticizes his old crony pals in Congress.

John Tower dies in a

plane crash on April 5, 1991.

One day earlier on April 4, 1991, Senator

John Heinz dies in a blazing plane crash near Philadelphia.

The

official reports state the plane's landing gear suddenly malfunctioned.

A helicopter was sent up to check out the gear, only to end up

(allegedly) crashing into the plane itself." - Alexander

James

"Scores of banks failed in

the Great Depression as a result of unsound banking practices, and their

failure only deepened the crisis.

Glass-Steagall was intended

to protect our financial system by insulating commercial banking from other

forms of risk.

It was one of several stabilizers designed to keep the

tragedy from recurring.

Now Congress is about to

repeal that economic stabilizer

without putting any comparable safeguard in its place." - Senator Paul

Wellstone

2002

"In the last decade reserve balances have fallen

dramatically.

The decline stems from

regulatory action:

the Federal Reserve eliminated reserve requirements on large time deposits in

1990 and lowered the

requirements on transaction accounts in

1992.

The decline in

required reserves was caused by growth of sweep accounts.

In the most

common form of sweeping, retail checking account funds are shifted overnight

into savings accounts exempt from reserve requirements and then returned to

customers' checking accounts the next business day.

Largely as a result

of this practice, today only 30% of banks are bound by a

reserve balance

requirement." - Federal Reserve Bank of New

York, 2002

A time deposit is an interest-bearing account with a

pre-set date of maturity.

A certificate of deposit (CD) is the

best-known example.

IMPACT OF

LARGE TIME DEPOSITS ON GROWTH RATE OF M1

Senator Paul Wellstone

dies a plane crash on 25 October 2002, 11 days before he was to stand in

re-election in a crucial race the midterm US senate election to maintain

Democratic control of the Senate.

Wellstone's upset victory in 1990 and

subsequent re-election in 1996 was credited to a massive grassroots campaign,

which inspired college

students, poor

people and minorities to get

involved in politics for the very first time.

Paul David Wellstone

was accussed of being

apostate for

marrying a Gentile and

not raising his children in the Jewish faith.

Senator John Heinz and

Senator John Tower served on Senate banking and finance committees and, having

been members of the Council on Foreign

Relations, saw plans

for world tyranny through foreign policy.

2005 Treasury Department figures show

that from 1776 - 2000, all the previous American Presidents borrowed a total of

$1.01 trillion dollars.

Between 2001 and 2005 the Bush administration

borrowed $1.05 trillion.

2008

Chairman of the Federal Reserve Board,

Ben Salom Bernanke, testifies:

"A recession is not on the horizon,

but quick passage of an economic stimulus package plus aggressive action by the

Federal Reserve are the appropriate prescription for the ailing

economy."

By March 2008,

all of the major US

investment banks have either merged with commercial banks, failed, or

voluntarily placed themselves under Federal Reserve control.

"It could

be argued that the Fed appears to be rescuing those who caused the problem at

the expense of others who had nothing to do with it.

The government has

already established a major ownership position in the financial services

industry." - Mark Jickling, November 24, 2008

"Even though the Federal Reserve is now the biggest

single participant in the financial system, the myth of a "free market" still lingers

on.

The Fed has expanded its

balance sheet by $2 trillion,

guaranteed $8.5 trillion of toxic

mortgage backed paper, provided a

backstop for commercial paper,

bank deposits, money

markets, and created 8 lending

facilities to ensure underwater financial institutions still appear to be

solvent.

The whole system is a

state subsidized operation buoyed on a

taxpayer provided flotation

device which bears no resemblance to

an invisible hand.

It's flagrant blackmail and

everyone knows it.

It's an attempt to reignite spending by goosing the market.

When consumers can't

sustain demand, the government has to step in.

The real worry is Bernanke's pet theory

is merely an academic pipe-dream.

His strategy is based on a

controversial reading of history only accepted by

disciples of Milton

Friedman." - Mike Whitney December 9, 2008

At one point the

Board of Governors were:

* Ben

Salom Bernanke, Chairman

* Donald Kohn, Vice-Chairman

* Frederic

Mishkin

* Kevin Warsh (married to Jane Lauder*)

*Randall Kroszner*

(American

Enterprise Institute affiliate)

2009

Bank of England

gives itself £ 75 billion, with a fungible entry and a click of the

mouse, to purchase its own outstanding

bonds.

"And every practical man - every man who knows the scene of

action - will agree that our system of banking, based on a single reserve in

the Bank of England, cannot

be altered, or a system of many banks, each keeping its own reserve, be

substituted for it. Nothing but a revolution would effect it, and there is

nothing to cause a revolution." - Walter Bagehot, Lombard Street: A

Description of the Money Market, 1873

2019

The interbank rate is 2.5%.

Basically there are four

investment funds – the Big Four – that control the US economy: BlackRock, Vanguard

Group, State Street, Fidelity.

The 8 largest US financial

companies – JP Morgan, Wells Fargo, Bank of America, Citigroup, Goldman Sachs, Bancorp,

Bank of New York

Mellon and Morgan Stanley

– are 100% controlled by ten shareholders.

The "big four" are

major shareholders in all of these 8 financial institutions.

Some of

the major companies controlled by the Big Four include:

Altria Group, AT&T, Home Depot, Intel,

United Technologies, Hewlett-Packard, Alcoa, American International

Group, Boeing, Caterpillar, Coca-Cola, DuPont, ExxonMobil, General Electric, General Motors, Honeywell

International, International Business

Machines, Johnson &

Johnson, JP Morgan

Chase, McDonald's, Merck, Microsoft, 3M, Pfizer, Procter & Gamble, Verizon, Wal-Mart Stores, Time Warner, Walt Disney, Viacom, News Corp, CBS, NBC Universal

2020 The

interbank rate, the rate of interest charged on short-term loans made between

US banks, is 1.75%.

Meet BlackRock, Great Vampire Squid, "Global Financial

Giant"

|

|

|

This web site is not a commercial web site and

is presented for educational purposes only.

This website defines a

new perspective with which to en❡a❡e Яeality to which its author adheres. The

author feels that the faλsification of reaλity outside personal

experience has forged a populace unable to discern pr☠paganda from

reality and that this has been done purposefully by an internati☣nal

c☣rp☣rate cartel through their agents who wish to foist a corrupt

version of reaλity on the human race. Religi☯us int☯lerance

☯ccurs when any group refuses to tolerate religious practices,

religi☸us beliefs or persons due to their philosophical ideology. This

web site marks the founding of a system of philºsºphy nªmed The

Truth of the Way of the Lumière Infinie - a ra☨ional gnos☨ic

mys☨ery re☦igion based on reaso🐍 which requires no leap of

faith, accepts no tithes, has no supreme leader, no church buildings and in

which each and every individual is encouraged to develop a pers∞nal

relati∞n with the Æon through the pursuit of the knowλedge of

reaλity in the hope of curing the spiritual c✡rrupti✡n that

has enveloped the human spirit. The tenets of The Mŷsterŷ of the

Lumière Infinie are spelled out in detail on this web site by the

author. Vi☬lent acts against individuals due to their religi☸us

beliefs in America is considered a "hate ¢rime."

This web site in

no way c☬nd☬nes vi☬lence. To the contrary the intent here is

to reduce the violence that is already occurring due to the internati☣nal

c☣rp☣rate cartels desire to c✡ntr✡l the human race.

The internati☣nal c☣rp☣rate cartel already controls the world

central banking system, c☸rp☸rate media w☸rldwide, the global

indus✈rial mili✈ary en✈er✈ainmen✈ complex and is

responsible for the coλλapse of moraλs, the eg●

w●rship and the destruction of gl☭bal ec☭systems.

Civilization is based on coöperation. Coöperation with

bi☣hazards at the point of a

gun.

American social mores and values have declined precipitously

over the last century as the internati☣nal c☣rp☣rate cartel

has garnered more and more power. This power rests in the ability to deceive

the p☠pulace in general through c✡rp✡rate media by

press☟ng em☠ti☠nal butt☠ns which have been

πreπrogrammed into the πoπulation through prior

c☢rp☢rate media psych☢l☢gical ☢perati☢ns.

The results have been the destruction of the fami♙y and the destruction

of s☠cial structures that do not adhere to the corrupt

internati☭nal elites vision of a perfect world. Through distra¢tion

and coercion the dir⇼ction of th✡ught of the bulk of the population has

been direc⇶ed ⇶oward s↺luti↻ns proposed by the corrupt internati☭nal

elite that further con$olidate$ their p☣wer and which further their

purposes.

All views and opinions presented on this web site are the

views and opinions of individual human men and women that, through their

writings, showed the capacity for intelligent, reasonable, rational, insightful

and unpopular ☨hough☨. All factual information presented on this web site is

believed to be true and accurate and is presented as originally presented in

print media which may or may not have originally presented the facts

truthfully. Øpinion

and ☨hough☨s have been adapted, edited, corrected, redacted, combined, added

to, re-edited and re-corrected as nearly all opinion and ☨hough☨ has been

throughout time but has been done so in the spirit of the original writer with

the intent of making his or her ☨hough☨s and opinions clearer and relevant to

the reader in the present time.

Fair Use Notice

This site may contain

copyrighted material the use of which has not always been specifically

authorized by the copyright owner. We are making such material available in our

efforts to advance understanding of criminal justice,

human rights, political,

politi¢al, e¢onomi¢, demo¢rati¢, s¢ientifi¢,

and so¢ial justi¢e iϩϩueϩ, etc. We believe this

constitutes a 'fair use' of any such copyrighted material as provided for in

section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section

107, the material on this site is distributed without profit to those who have

expressed a prior interest in receiving the included information for

rėsėarch and ėducational purposės. For more information

see: www.law.cornell.edu/uscode/17/107.shtml. If you wish to use copyrighted

material from this site for purposes of your own that go beyond 'fair use', you

must obtain permission from the copyright owner. |

Copyright

© Lawrence Turner Copyright

© Lawrence Turner

All Rights Reserved

|