|

1300

Venetian moneylenders began to sell debt issues to other lenders and to

individual investors.

1500 Belgium exchange

dealt exclusively in promissory notes and bonds.

"Slavery is likely to be

abolished by the war power and chattel slavery destroyed.

This I and my European

friends are glad of,

for slavery is but the owning of

labor and carries with it the care of the laborer, while

the European plan led by England is for

capital to control labor by controlling wages.

This can be done by controlling the money.

Debt is a means to control the volume of money.

To accomplish

this BONDS must be used.

We are now waiting

for the Secretary of the

Treasury to make his recommendation to Congress.

It will not do to

allow the Greenback, as it is called, to circulate as money

any length of time, as we cannot control that." - Hazzard Circular, 1862, Bank

of England

1864

International bankers take

control.

National

Banking Act specifies the entire US money supply will be printed out of

debt by the national banks through the purchase of US treasury bonds by issuing

them as assets backing treasury banknotes.

US treasury bonds, or

T-bills, are guaranteed by the US government.

As long as the US

government is solvent US treasury bonds

retain value.

A US treasury bond, or treasury note, is

a promissary note.

A promissary note is

a promise to pay a specified amount on a specified date.

They typically

include an interest payment for

the use of capital while held.

A bond is a debt security, paper

collateral for the loan.

A bearer bond is a bond or debt security issued

by an incorporated entity.

Bonds issued by corporations are

corporate bonds or junk

bonds.

"In years following the war,

the federal government ran

a heavy surplus.

It could not however pay off its debt, retire its

securities, because to do so meant there would be no bonds to back the

national bank notes.

To pay off national debt was to

destroy the money supply." - John Kenneth

Galbraith

1861 Moses Taylor, Chairman of the Loan Committee to

finance the Union in the Civil War, offers the government $5,000,000 of US

treasury bonds at 12% at a 33% shaving to continue financing the Civil War.

It is suggested Abraham Lincoln go to Congress to requestingthe passage

a bill authorizing the printing of full legal tender treasury

notes.

"To pay the soldiers the Government issued Treasury notes,

authorized by act of Congress, July 17, 1861, for $50,000,000, bearing no

interest.

These notes circulated at par with gold.

Rothschild

agents inspired the American banks to offer to Lincoln a loan of up to $150

million.

But before they had taken much of the loan, the banks broke

down and suspended specie payments in December 1861.

They wished to

blackmail Lincoln and demanded the 'shaving' of government paper to the extent

of 33%, an extortion

which was refused.

A bill drafted for government issue of $150 million,

which should be full legal tender for every debt in the US, passed the House of

Representatives Feb. 25, 1862, and was hailed with delight by the entire

country.

The Wall Street bankers were

furious." - Arthur Cherep-Spiridovich

1893 "The interests of national banks require immediate

financial legislation by Congress (the US Government).

Silver, silver

certificates, and Treasury bonds (all government money) must be retired, and

National Bank Notes made the only money.

This will require the

authorization of $500 million to $1 billion of new bonds as the basis of

circulation.

At once retire one-third of your currency and call in

one-half of your loans.

Be careful to make a monetary stringency among

your patrons, especially among influential businessmen.

Advocate an

extra session of Congress to repeal the purchasing clause of the Sherman

Law, and act with other banks of your city in securing a large petition to

Congress for its unconditional repeal per accompanying form.

Use

personal influence with your Congressmen, and particularly let your wishes be

known to your Senators.

The future life of national banks depends upon

immediate action, as there is an increasing sentiment in favor of government

legal-tender notes and silver coinage."- "The Panic Circular", American

Bankers' Association 1893

"Traditional money systems depend on faith

and

general ignorance to stay afloat." - Jason Rohrer

"The truth is that no bank lends as much as

a penny of the money deposited with it.

Every bank loan or overdraft is a creation of entirely new money

(credit) and is a clear addition to the amount of money in the community.

It is no more than a record in a bank ledger

or computer and is actually the creation of new money out of nothing." -

Jane Birdwood

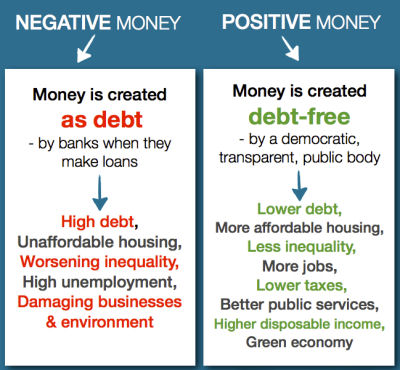

"The bank-debt currency system we have today is founded

upon interest.

That's the motivation for banks to create

money in the first place.

Creating money is only a side effect,

irrelevant to the commercial bank, of their main purpose of earning a profit.

Another effect is the necessity of perpetual economic growth and

conversion of all

common wealth into

private monetary wealth." -

Charles Eisenstein

"It started with

goldsmiths.

Early

bankers initially provided safekeeping services by making a profit from vault

storage fees for gold and coins deposited.

People would redeem their

"deposit receipts" whenever they needed gold or coins to purchase something,

and physically take the gold or coins to the seller who, in turn, would

deposit them for

safekeeping, often with the same banker.

Everyone soon found that it

was a lot easier simply to use the deposit receipts directly as a means of

payment.

These receipts, promissary notes, were acceptable as

money since whoever held them could go to the banker and exchange them for gold

and coins.

Then, bankers discovered that they could make loans merely by

giving their promise to pay, or bank notes, to borrowers.

In this way,

banks began to create money.

More notes could be issued than the gold

and coin on hand because only a portion of the notes outstanding would be

presented for payment at any one time.

A fractional reserve of gold and

coin had to be kept on hand to redeem whatever volume of notes was presented

for payment.

Transaction deposits are the modern counterpart of bank

notes.

It was a small step from printing notes to making book entries

crediting deposits of borrowers, which the borrowers in turn could "spend" by

writing checks." - Chicago Federal Reserve, Modern Money

Mechanics

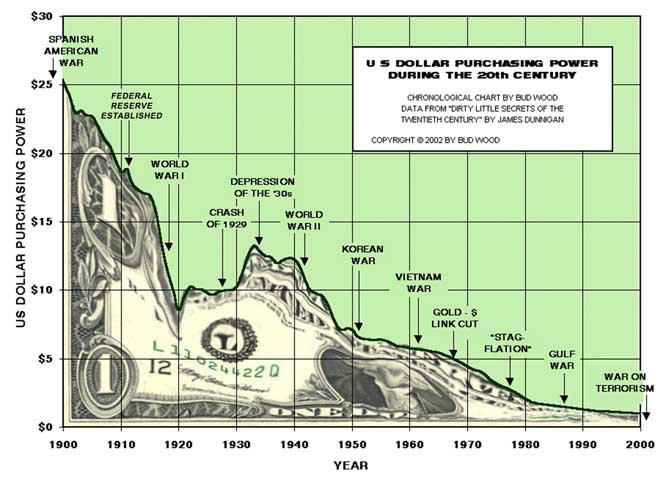

In a

fractional reserve banking

system, such as the fiat paper

money/fungible asset

system used internationally, the debt

has to continue to climb until, at some point, it must be

forgiven.

Debtors can never aquire

enough capital to fully pay off their debt.

In a closed fractional

reserve system money is only printed through loans like the ones granted by the

BIS today.

When $10 is deposited $100 is loaned out.

Assume an annual

interest rate of 10%.

The borrower is required to pay $110 back to

the bank, but $10 is still held as reserves by the bank and only $100 has been

put out into circulation.

Where does the extra $10 to be paid as

interest come from?

"Imagine the first bank which prints and lends out

$100.

For its efforts it asks for the borrower to return $110 in one

year; that is it asks for 10% interest.

The bank has created

a mathematically impossible

situation.

The only way in which the borrower can return 110 of the

bank's notes is if the bank prints and lends more.

The result of

creating 100 and demanding 110 in return, is that the collective borrowers of a

nation are forever chasing a phantom which can never be caught; the

mythical $10 that was never

printed.

The debt is in fact, unrepayable.

Each time $100 is

printed, the nation's overall indebtedness to the system is increased by $110.

The only solution at present is increased borrowing to cover the

principal plus the interest of what has been borrowed." - Roger Langrick

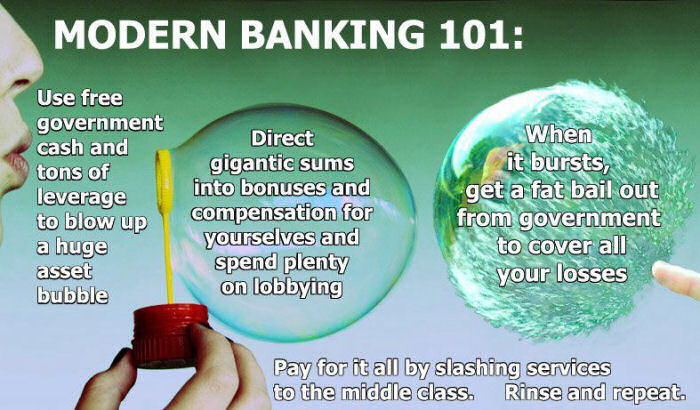

Economists,

financial marketers,

refer to "the business

cycle," "boom and bust,"

"recession," "depression",

"tech bubble" and "housing bubble" in order to

confuse and

distract - as "asset bubbles" are real.

Banking families

intermarry and building international

dynasties.

Frederick Soddy defines banks: "Institutions which pretend to lend money,

do not lend it, but create it, and when it is repaid, de-create it and have

achieved the physically impossible

miracle thereby, not only of getting something for nothing but also of

getting perennial interest from it."

The money changers soon discovered

that their control of this fraudulent

paper promissary note money supply, as

there was more paper in circulation than in

deposits, gave them

control over the economy and the assets of many of those who had borrowed

money.

The money changers exacted their control of the economy and

their wealth accumulation by manipulating the

money supply - easy money and

tight money - economic

contraction and expansion.

securitizing loans

"What we have found over

the years in the marketplace is that derivatives have been an extraordinarily

useful vehicle to transfer risk from those who shouldn't be taking it to

those who are willing to and are capable of doing so." - Alan Greenspan

2003

"Clearly, derivatives are a

centerpiece of the crisis, and Alan Greenspan was the leading proponent of

the deregulation of derivatives."

- Frank Partnoy 10/08/08

"The derivatives market is $531 trillion, up from

$106 trillion in 2002 and a relative pittance just two decades ago. Alan

Greenspan banked on the good will of Wall Street to

self-regulate." - Peter S.

Goodman 10/08/09

Investment banks are able to "balance" and prove

adequate reserves by "securitizing" loans which allows investment banks to

move those loans off the balance

sheets.

There are two ways to securitize a

loan:

sell the securitized loan as a 'corporate' bond (originally

made popular by Michael Robert Milken* as

junk bonds);

or "synthetic"

securitization: use of derivatives to get rid of the risk of default (with

credit default swaps) and

lock in the interest rate due on the loan (with

interest-rate default

swaps).

Once an investment bank securitizes a loan that it is

off the balance

sheet.

Once a loan has been moved

off the balance sheet the capitalization ratio improves and the

investment banks can make even more

loans.

Investment banks print

trillions of dollars of credit without maintaining adequate capital reserves

(leveraged up to 33 to 1 - 3.3 times

higher than the traditional fractional reserve of 10 to 1) by providing

sub-prime mortgages, student loans and credit card

loans to millions of loan applicants who have no documentation, no income,

no collateral and a bad credit history for enormous short term

profits!

Investment

banks did this without tying up any of their capital reserves while

con-vincing the

purchasers of the

securitized

commercial paper that there was no risk of default!

"Bankers are in the debt business, and if

governments are allowed to create enough money to

keep themselves and

their constituents out of debt, lenders will be out of business.

The central banks charged

with maintaining the banking business therefore insist on a stable currency at

all costs, even if it means slashing services, laying off workers, and soaring

debt and interest burdens.

For the financial business to continue to

boom, governments must not be allowed to create money themselves, either by

printing it outright or by borrowing

it into existence from their own government-owned banks." - Ellen

Brown

Federal Reserve issues stock which is held by

over 2,900 banks.

The Federal Reserve pays a 6 percent dividend which

amounted to $1.637 billion in 2012, the last year of available data.

Fed Open Market Committee creates money out of

nothing!

Most "currency" is now in the form of electronic

spreadsheets, rather than paper records such as ledgers.

Open market operations are conducted

simply by electronically increasing or decreasing ('crediting' or 'debiting')

the amount of currency that a bank has in its reserve account at the central

bank in exchange for a fungible instrument -

an entry in an electronic

spreadsheet !

Currency

magically appears when the balance in a reserve account is increased.

The newly printed currency is

then used by the central bank to purchase on the open market fungible instruments which may or

may not be backed with tangible financial assets, such as US bonds, foreign

currency, or gold.

When the

central bank sells fungible instruments on

the open market, the amount of currency

the purchasing bank holds decreases, effectively destroying

currency.

The US Treasury sells marketable securities - T-Bills,

promissary notes, bonds, and Treasury Inflation-Protected Securities

(TIPS) to the public through regular public auctions to raise the cash needed

to operate the US government and to refund maturing

securities.

Marketable securities are fungible financial

instruments.

Marketable

securities are simply government IOU's.

Marketable securities can be bought, sold or

transferred after they issue.

Marketable

securities are purchased in order to get a secure rate of interest.

At the end of the term of the

marketable security,

the US Treasury repays the principle, plus interest and the

marketable security is

destroyed - ie. the fungible instrument is deleted from the electronic

speadsheet.

For example one of the twelve Fed banks -

Boston, New York,

Philadelphia, Cleveland,

Richmond, Atlanta, Chicago,

St. Louis, Minneapolis, Kansas City, Dallas,

San Francisco - that make up the Federal Reserve system exchanges a fungible

instrument for $1,000,000 of marketable securities with the US Treasury.

When the fractional

reserve is 10% - $10,000,000 can then be loaned on a $1,000,000 purchase of

marketable Treasury securities.

Regional Federal Reserve Banks then issues

loans to regional member banks.

To reduce the amount of money in

circulation this process is simply reversed.

When the Federal Reserve

sells marketable securities to the public the money flows out of regional

banks.

When the fractional reserve is 10% - regional loans must be then

reduced by ten times the amount of the US Treasury marketable securities.

A purchase of $1,000,000 in marketable securities results in a

$10,000,000 reduction of currency in the regional economy when fractional

reserve rules are observed.

"The financial system has been turned

over to the Federal Reserve Board. That board administers the finance system by

authority of a purely profiteering

group." - Charles A Lindbergh Sr.Federal Reserve

controls the amount of currency in circulation in two ways.

The first

way the Federal Reserve controls the amount of currency in circulation is

through the purchase and sale of marketable

securities.

The second way the Federal Reserve controls the amount

of currency in circulation is through the interest rate it charges its member

banks.

But the Federal Reserve also controls the interest rate on the

marketable securities through the purchase and sale of

marketable securities.

When the

US Treasury offers more marketable securities

than the rate of demand of those

marketable securities then

the Federal Reserve can step in and purchase the excess capacity to

keep interest rates low or the Federal Reserve

can refuse to purchase those marketable

securities and the interest rate on those

marketable securities will

increase to draw in needed capital.

When interest rates go up less

currency is loaned out and less currency in

the system creates contraction - recession or depression.

Monetary

policy, set by the privately owned and operated Federal Reserve, is highly

independent of effective political control.

Federal Reserve is

subservient only to Bank of

International Settlements.

municipal debt bonds

Christopher "Kit" Taylor, the former chief regulator and

executive director of the

Municipal Securities Rulemaking Board from 1978 to 2007, said the

members of the board wouldn't allow the group to

set rules on credit default swaps and derivatives for the $2.69 trillion

municipal bond market.

"The big firms didn't want us touching derivatives.

They said,

'Don't talk about it, Kit.'

I saw bankers looking out for their self

interest in my years at the MSRB.

The

attitude changed from,

'What can we do for the good of

the market,' to, 'What can we I do to ensure the future of my

business.'

The profit wasn't in the

underwriting, it was in

the swap.

Right up until the day we went to real-time disclosure, I was

getting calls from bankers wanting to delay it.

The only ones who

benefited from delaying transparency were those who profited from the trades."-

Christopher "Kit" Taylor

1975 Congress set up the Municipal

Securities Rulemaking Board to make rules for firms that

underwrite, trade and

sell municipal debt.

The board, funded by member firms, generates

$22.2 million in fiscal 2008..

As a

self-regulatory organization, members of the industry are granted the authority

to supervise their own practices.

A 15-member board oversees the

organization and 10 of the directors are from

Wall Street firms.

Enforcement is handled by the Securities and Exchange Commission.

August 1983 Washington Public Power Supply

System bonds to build five nuclear reactors default.

January 2010 Las Vegas Monorail bonds default.

November 9, 2011 Jefferson County Commission voted 4 to 1 to

declare bankruptcy on roughly $4 billion in

municipal debt.

2011 28 defaults totaling $522

million.

June 28, 2012 Stockton files for Chapter

9 protection.

2012 21 defaults on muni debt

totaling $978 million, according to Richard Lehmann, publisher of Distressed

Debt Securities Newsletter.

July 18, 2013 Detroit

files for bankruptcy on a municipal debt

of $20 billion.

Aug 04, 2015 Puerto Rico defaults

on a $58 million bond.

July 1, 2016 Puerto Rico

defaults on $ 2 billion bond. |

|

|

This web site is not a commercial web site and

is presented for educational purposes only.

This website defines a

new perspective with which to en❡a❡e Яeality to which its author adheres. The

author feels that the faλsification of reaλity outside personal

experience has forged a populace unable to

discern pr☠paganda

from Яeality and that this has been done purposefully by an

internati☣nal c☣rp☣rate

cartel through their agents who wish to foist a corrupt version of

reaλity on the human race. Religi☯us int☯lerance ☯ccurs

when any group refuses to tolerate religious practices, religi☸us beliefs

or persons due to their philosophical ideology. This web site marks the

founding of a system of philºsºphy nªmed The Truth of the Way of

the Lumière Infinie - a ra☨ional gnos☨ic mys☨ery

religion based on reaso🐍 which requires no leap of faith, accepts no

tithes, has no supreme leader, no church buildings and in which each and every

individual is encouraged to develop a pers∞nal relati∞n with the

Æon through the pursuit of the knowλedge of reaλity in the hope

of curing the spiritual c✡rrupti✡n that has enveloped the human

spirit. The tenets of The Mŷsterŷ of the Lumière Infinie are

spelled out in detail on this web site by the author. Vi☬lent acts

against individuals due to their religi☸us beliefs in America is

considered a "hate ¢rime."

This web site in no way

c☬nd☬nes vi☬lence. To the contrary the intent here is to

reduce the violence that is already occurring due to the internati☣nal

c☣rp☣rate cartels desire to c✡ntr✡l the human race.

The internati☣nal c☣rp☣rate cartel already controls the

w☸rld ec☸n☸mic system, c☸rp☸rate media

w☸rldwide, the global indus✈rial mili✈ary

en✈er✈ainmen✈ complex and is responsible for the collapse of

morals, the eg● w●rship and the destruction of gl☭bal

ec☭systems. Civilization is based on coöperation. Coöperation

with bi☣hazards at the point

of a gun.

American social mores and values have declined

precipitously over the last century as the internati☣nal

c☣rp☣rate cartel has garnered more and more power. This power rests

in the ability to deceive the p☠pulace in general through

c✡rp✡rate media by press☟ng em☠ti☠nal

butt☠ns which have been πreπrogrammed into the

πoπulation through prior c✡rp✡rate media psychological

operations. The results have been the destruction of the fami♙y and the

destruction of s☠cial structures that do not adhere to the corrupt

internati☭nal elites vision of a perfect world. Through distra¢tion

and coercion the dir⇼ction of th✡ught of the bulk of the

p☠pulati☠n has been direc⇶ed ⇶oward

s↺luti↻ns proposed by the corrupt internati☭nal elite that

further con$olidate$ their p☣wer and which further their purposes.

All views and opinions presented on this web site are the views and

opinions of individual human men and women that, through their writings, showed

the capacity for intelligent, reasonable, rational, insightful and unpopular

☨hough☨. All factual information presented on this web site is

believed to be true and accurate and is presented as originally presented in

print media which may or may not have originally presented the facts

truthfully. Øpinion and

☨hough☨s have been adapted, edited, corrected, redacted, combined,

added to, re-edited and re-corrected as nearly all opinion and

☨hough☨ has been throughout time but has been done so in the spirit

of the original writer with the intent of making his or her

☨hough☨s and opinions clearer and relevant to the reader in the

present time.

Fair Use Notice

This site may contain

copyrighted material the use of which has not always been specifically

authorized by the copyright owner. We are making such material available in our

efforts to advance understanding of ¢riminal justi¢e, human

rightϩ, political, politi¢al, e¢onomi¢,

demo¢rati¢, s¢ientifi¢, and so¢ial justi¢e

iϩϩueϩ, etc. We believe this constitutes a 'fair use' of any

such copyrighted material as provided for in section 107 of the US Copyright

Law. In accordance with Title 17 U.S.C. Section 107, the material on this site

is distributed without profit to those who have expressed a prior interest in

receiving the included information for rėsėarch and ėducational

purposės. For more information see:

www.law.cornell.edu/uscode/17/107.shtml. If you wish to use copyrighted

material from this site for purposes of your own that go beyond 'fair use', you

must obtain permission from the copyright owner. |

Copyright

© Lawrence Turner Copyright

© Lawrence Turner

All Rights Reserved

|