|

Three International

Corporations

for the Elven-Kings under the Silken

Sky,

Seven for the Dwarf-Lords in Halls of

LodeStone,

Nine for

Mortal Men Doomed to

Die,

One for the Dark Lord on his Dark

Throne

In the Land of

Mordor where the Shadows lie.

One Supreme International

Corporation

to rule them all,

One Supreme International

Corporation

to find them,

One Supreme International

Corporation,

, ,

to bring them into the Darkness and bind

them

In the Land of

Mordor where

the Shadow

Governments lie to us all.

"In the past the man has been first;

in the

future the system must be first."

Frederick Winslow

Taylor

Principles of Scientific Management

"Corporate libertarianism" - a

totally different animal than individual libertarianism -

has emerged placing corporations

above individuals.

This

influence led to cultural ideologies known by numerous names such as

neoliberal, neolibertarian

economics, market

capitalism, market liberalism etc which in truth is nothing other than

neofeudalism in

disguise.

The guiding

principles of corporatism include:

Sustained corporate growth as the way

to human progress.

Free

markets without government "interference" as

the most efficient and socially

optimal allocation of resources.

Corporate globalization as beneficial to

everyone.

Privatization removes

inefficiencies of public sector.

The only function of government is

to provide infrastructure and to

advance the rule of law

with respect to property

rights and contracts.

"The

idea that some areas of society and life are too

precious, vulnerable,

sacred, or

important for the public interest to be

subject to commercial

exploitation seems to be losing its influence." - Joe

Balkan

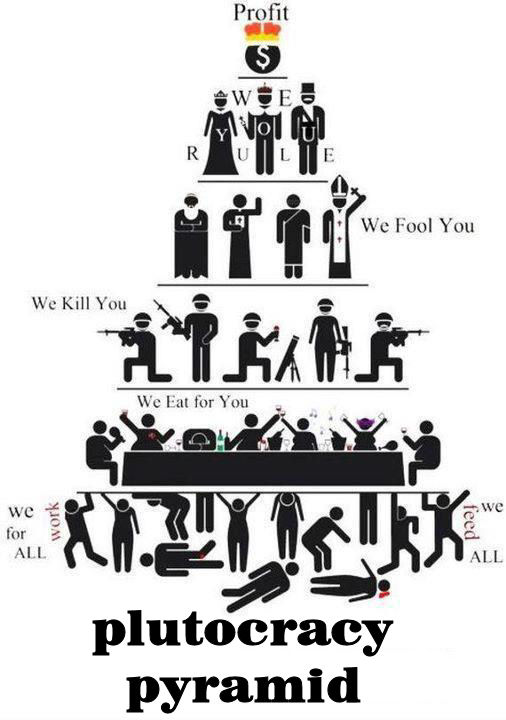

77 billionaires ~ 2005, about 1 in 4, started out

with a huge inheritance. Forbes 400

2005

The wealthy

need winners and

losers in order to

increase wealth parasitically

stolen and, to keep it, they need only bet on the winning

side - themselves.

"Why should

men leave great fortunes to their children?

If this is

done from affection, is it not

misguided affection?

Observation teaches

children should not be so

burdened.

Men who continue hoarding great sums all their lives, the

proper use of which for public ends work good to the community,

should be made to feel that the

community, in the form of the

State, cannot be deprived of

its proper share.

By taxing estates heavily at death the State marks

its condemnation of the selfish

billionaire's unworthy life." -

Andrew

Carnegie

|

|

$$$ |

|

|

| Petroleum, natural gas & electricity |

|

|

|

| Charles De Ganahl Koch |

12 billion |

Wichita, KS |

petroleum inheritance |

| David Hamilton Koch* |

12 billion |

New York, NY |

petroleum inheritance |

| William Ingraham Koch* |

1.3 billion |

Palm Beach, FL |

inheritance petroleum |

| Robert Muse

Bass |

5.5 billion |

Fort Worth, TX |

inheritance petroleum, |

| Lee Marshall Bass |

3 billion |

Fort Worth, TX |

inheritance petroleum, |

| Sid Richardson Bass |

3 billion |

Fort Worth, TX |

inheritance petroleum, |

| Edward Perry Bass |

2.5 billion |

Fort Worth, TX |

inheritance petroleum, |

| Anne Windfohr Marion |

1.3 billion |

Fort Worth, TX |

inheritance, petroleum |

| William Alvin Moncrief Jr |

1 billion |

Fort Worth, TX |

inheritance petroleum |

| Richard Edward Rainwater |

2.5 billion |

Fort Worth, TX |

real estate, energy,

insurance |

| Robert Rowling |

5.2 billion |

Dallas, TX |

inheritance petroleum &

gas |

| Ray Lee Hunt |

3.2 billion |

Dallas, TX |

inheritance, real estate |

| T Boone Pickens, Jr |

2.7 billion |

Dallas, TX |

petroleum & gas, hedge

funds |

| Trevor Rees-Jones |

1.5 billion |

Dallas, TX |

petroleum |

| Timothy Headington |

1.1 billion |

Dallas, TX |

petroleum |

| Billy Joe "Red" McCombs |

1.3 billion |

San Antonio, TX |

radio, petroleum, real

estate |

| Jeffrey Hildebrand |

1 billion |

Houston, TX |

petroleum |

| Tracy W Krohn |

1.4 billion |

Houston, TX |

petroleum |

| Dan L Duncan |

7.5 billion |

Houston, TX |

petroleum, gas pipelines |

| Richard Kinder |

2.8 billion |

Houston, TX |

gas pipelines |

| George Phydias Mitchell |

2.5 billion |

The Woodlands, TX |

petroleum |

| David Rockefeller Sr |

2.6 billion |

New York, NY |

petroleum, banking |

| Gordon Peter Getty |

2.3 billion |

San Francisco, CA |

petroleum inheritance |

| George B Kaiser |

8.5 billion |

Tulsa, OK |

petroleum inheritance,

banking |

| Aubrey K McClendon |

1.6 billion |

Oklahoma City, OK |

petroleum |

| Marguerite Harbert |

1.5 billion |

Birmingham, AL |

petroleum inheritance |

| Richard Mellon Scaife |

1.2 billion |

Pittsburgh, PA |

ipetroleum, banking,

publishing |

| Philip Frederick Anschutz* |

7.8 billion |

Denver, CO |

petroleum, gas, fiber optics |

| Phyllis Miller Taylor |

1.6 billion |

New Orleans, LA |

petroleum, gas |

| Tom L Ward |

1.6 billion |

Edmond, OK |

gas |

| Robert Earl Holding |

4.2 billion |

Sun Valley, ID |

energy, resorts, ranching |

| Robert C McNair |

1.5 billion |

Houston, TX |

energy,

sports |

Hedge funds |

|

|

|

| George Soros* |

8.5 billion |

Westchester, NY |

hedge funds |

Edward S

Lampert

(Skull &

Crossbones)

protege: Robert

Rubin* |

4.7 billion |

Greenwich, CT |

consumer products,hedge

funds |

| James H

Simons |

4 billion |

East Setauket, NY |

hedge funds |

| Steven A Cohen* |

3 billion |

Greenwich, CT |

hedge funds |

| Paul Tudor Jones II |

2.5 billion |

Greenwich, CT |

hedge funds |

| Bruce Kovner * |

3 billion |

New York, NY |

hedge funds |

| Stanley Druckenmiller * |

2 billion |

New York, NY |

hedge funds |

| Israel Englander * |

1.2 billion |

New York, NY |

hedge funds |

| David E Shaw |

1 billion |

New York, NY |

hedge funds |

| Louis Moore Bacon |

1 billion |

London |

hedge funds |

| Kenneth C Griffin* |

1.7 billion |

Chicago, IL |

hedge funds |

| David Tepper* |

1.5 billion |

Chatham, NJ |

hedge funds |

| Samuel Wyly* |

1.1 billion |

Dallas, TX |

stock trader, hedge funds |

| Daniel Morton Ziff* |

1.5 billion |

New York, NY |

inheritance, hedge funds |

| Dirk Edward Ziff* |

1.5 billion |

New York, NY |

inheritance, hedge funds |

| Robert David Ziff* |

1.5 billion |

New York, NY |

inheritance, hedge funds |

Leveraged buyouts

or hostile takeovers |

|

|

|

| Carl Icahn * |

9.7 billion |

New York, NY |

leveraged buyouts |

| Ronald Owen Perelman * |

7 billion |

New York, NY |

leveraged buyouts |

| Henry R Kravis * |

2.6 billion |

New York, NY |

leveraged buyouts |

| Leon Black * |

2 billion |

New York, NY |

leveraged buyouts |

| Thomas Haskell Lee * |

1.4 billion |

New York, NY |

leveraged buyouts |

| George R Roberts |

2.6 billion |

San Francisco, CA |

leveraged buyouts |

| Tom T Gores * |

2 billion |

Beverly Hills, CA |

leveraged buyouts |

| Alec Gores * |

1.2 billion |

Beverly Hills, CA |

leveraged buyouts |

| Nelson Peltz * |

1.3 billion |

Bedford, NY |

leveraged buyouts |

| Jerome Spiegel Kohlberg Jr * |

1.2 billion |

Mt Kisco, NY |

leveraged buyouts |

| Wilbur L Ross Jr |

1.2 billion |

Palm Beach, FL |

leveraged buyouts |

| David Howard Murdock* |

4.2 billion |

Los Angeles, CA |

leveraged buyouts |

| Harold Clark Simmons* |

4.1 billion |

Dallas, TX |

leveraged buyouts |

Stephen A Schwarzman *

(Skull

& Crossbones) |

3.5 billion |

New York, NY |

leveraged buyouts |

| J Christopher Flowers |

1.2 billion |

New York, NY |

leveraged buyouts |

| Michael Robert Milken * |

2.1 billion |

Los Angeles, CA |

junk bonds, leveraged

buyouts |

Money management |

|

|

|

| Fayez Shalaby Sarofim* |

1.5 billion |

Houston, TX |

money managment |

| Michael F Price |

1.4 billion |

Far Hills, NJ |

money managment |

| Robert Addison Day |

1.3 billion |

Los Angeles, CA |

money managment

(Superior

petroleum inheritence) |

| Kenneth L Fisher* |

1.3 billion |

Woodside, CA |

money managment |

| Julian H Robertson Jr |

1 billion |

New York, NY |

money management, wine |

| Alfred P West Jr |

1.2 billion |

Paoli, PA |

money management |

| Eli Broad* |

5.8 billion |

Los Angeles, CA |

mutual funds |

| Charles H Brandes |

2 billion |

San Diego, CA |

money management |

| Evgeny (Eugene) Markovich

Shvidler (partner Roman Arkadyevich Abramovich*) |

2.2 billion |

London, United Kingdom |

money management |

| Abigail Johnson |

13 billion |

Boston, MA |

mutual funds |

| Edward Crosby Johnson III |

7.5 billion |

Boston, MA |

money management |

| Charles Bartlett Johnson |

4.3 billion |

San Mateo, CA |

mutual funds |

| Rupert Harris Johnson Jr |

3.7 billion |

San Mateo, CA |

mutual funds |

| John P Calamos |

2 billion |

Naperville, IL |

mutual funds |

| Thomas Bailey |

1.2 billion |

Aspen, CO |

mutual funds |

| Joseph D Mansueto |

1.2 billion |

Chicago, IL |

mutual funds |

| Jonathan Lovelace Jr |

1.1 billion |

Los Angeles, CA |

mutual funds |

| Elizabeth S Wiskemann |

1.1 billion |

San Rafael, CA |

mutual funds |

| Charles R Schwab* |

4.6 billion |

Atherton, CA |

discount stock brokerage |

| J Joseph Ricketts |

2.3 billion |

Omaha, NE |

discount stock brokerage |

| William

H Gross |

1.2 billion |

Laguna Beach, CA |

bond broker |

| Peter R Kellogg |

2.5 billion |

Short Hills, NJ |

inheritance, stock trader |

Insurance and banking |

|

|

|

| Warren Edward Buffett |

46 billion |

Omaha, NE |

insurance |

| Franklin Otis Booth Jr |

1.9 billion |

Los Angeles, CA |

insurance |

| Charles T

Munger |

1.6 billion |

Los Angeles, CA |

insurance |

| Joan H Tisch * |

3.4 billion |

New York, NY |

hotels, insurance, tobacco, gas

|

| Wilma Stein Tisch* |

1.9 billion |

New York, NY |

hotels, insurance, tobacco, gas

|

| Maurice Raymond

Greenberg* |

2.8 billion |

Ocean Reef, FL |

insurance |

| Ernest S Rady |

2.2 billion |

San Diego, CA |

insurance, banking |

| Ernest E Stempel* |

1.7 billion |

Haton, Bermuda |

insurance |

| Arthur L Williams Jr |

1.7 billion |

Palm Beach, FL |

insurance |

| Sanford Weill * |

1.5 billion |

New York, NY |

insurance, banking |

| Peter Benjamin Lewis* |

1.4 billion |

Coconut Grove, FL |

insurance |

| William W McGuire |

1.2 billion |

Wayzata, MN |

insurance |

| George Joseph |

1 billion |

Los Angeles, CA |

insurance |

| Carl Henry Lindner Jr |

2.3 billion |

Cincinnati, OH |

insurance, banking |

| Clemmie Dixon Spangler Jr* |

2.5 billion |

Charlotte, NC |

banking |

| John Edward Anderson |

1.9 billion |

Bel Air, CA |

beer, banks, insurance, cars |

| Roland E. Arnall* |

3 billion |

Holmby Hills, CA |

mortgage banking* |

| Carl Pohlad |

2.6 billion |

Minneapolis, MN |

banking |

| T Denny Sanford* |

2.5 billion |

Sioux Falls, SD |

banking, credit cards |

| Herbert Anthony Allen Jr* |

2 billion |

New York, NY |

investment banking |

| Bernard Francis Saul II |

1.8 billion |

Chevy Chase, MD |

banking, real estate |

| Gerald Ford |

1.6 billion |

Dallas, TX |

banking |

| James Cayne |

1.1 billion |

New York, NY |

investment banking |

| Richard S Fuld Jr* |

1 billion |

Greenwich, CT |

investment banking |

| Leslie Alexander |

1.2 billion |

Houston, TX |

student loans |

| Daniel Gilbert |

1.1 billion |

Livonia, MI |

mortgage banking |

| Kenneth G Langone |

1 billion |

Sands Point, NY |

investment banking, building

supplies |

| L John Doerr |

1 billion |

Woodside, CA |

venture capital |

Publishing inheritance |

|

|

|

| Donald Edward Newhouse* |

7.3 billion |

Somerset County, NJ |

publishing inheritance |

| Samuel Irving Newhouse Jr * |

7.3 billion |

New York, NY |

publishing inheritance |

| Pauline MacMillan Keinath |

1.6 billion |

St Louis, MO |

publishing inheritance |

| Cargill MacMillan Jr |

1.6 billion |

Wayzata, MN |

publishing inheritance |

| W Duncan MacMillan |

1.6 billion |

Wayzata, MN |

publishing inheritance |

| Whitney MacMillan |

1.6 billion |

Minneapolis, MN |

publishing inheritance |

| John Hugh MacMillan III |

1.6 billion |

Hillsboro Beach, FL |

publishing inheritance |

| Marion MacMillan Pictet |

1.6 billion |

Haton, Bermuda |

publishing inheritance |

| Leonore Annenberg* |

2 billion |

Wynnewood, PA |

publishing inheritance |

Media amalgamation inheritance |

|

|

|

| Cox |

12 billion |

Honolulu, HI |

inheritance, media

amalgamation |

| Anne Cox Chambers |

12 billion |

Atlanta, GA |

inheritance, media

amalgamation |

| William Randolph Hearst III |

2.1 billion |

San Francisco, CA |

inheritance,

media amalgamation |

| Phoebe Hearst Cooke |

2 billion |

San Francisco, CA |

inheritance, media

amalgamation |

| Austin Hearst |

2 billion |

New York, NY |

inheritance, media

amalgamation |

| David Whitmire Hearst Jr |

2 billion |

Los Angeles, CA |

inheritance, media

amalgamation |

| George Randolph Hearst Jr |

2 billion |

Los Angeles, CA |

inheritance, media

amalgamation |

Walmart inheritance |

|

|

|

| Alice L Walton |

15 billion |

Fort Worth, TX |

inheritance consumer

products |

| Helen R Walton |

15 billion |

Bentonville, AR |

inheritance consumer

products |

| Jim C Walton |

15 billion |

Bentonville, AR |

inheritance consumer products |

| S Robson Walton |

15 billion |

Bentonville, AR |

inheritance consumer

products |

| Christy Walton |

15 billion |

Jackson, WY |

inheritance consumer

products |

| Ann Walton Kroenke |

2.6 billion |

Columbia, MO |

inheritance consumer

products |

| Nancy Walton Laurie |

2.2 billion |

Columbia, MO |

inheritance consumer

products |

Mars, Inc.

inheritance |

|

|

|

| Forrest Edward Mars Jr* |

10 billion |

McLean, VA |

inheritance processed food |

| Jacqueline Mars* |

10 billion |

Bedminster, NJ |

inheritance processed food |

| John Franklyn

Mars* |

10 billion |

Arlington, VA |

inheritance processed food |

SC Johnson & Sons inheritance |

|

|

|

| H Fisk Johnson |

1.6 billion |

Racine, WI |

chemicals inheritance |

| Imogene Powers Johnson |

1.6 billion |

Racine, WI |

chemicals inheritance |

| S Curtis Johnson |

1.6 billion |

Racine, WI |

chemicals inheritance |

| Helen Johnson-Leipold |

1.6 billion |

Racine, WI |

chemicals inheritance |

| Winnie Johnson-Marquart |

1.6 billion |

Virginia Beach, VA |

chemicals inheritance |

Hyatt hotels inheritance |

|

|

|

| Anthony Pritzker * |

2 billion |

Los Angeles, CA |

inheritance hotels |

| Daniel Pritzker * |

2 billion |

Marin County, CA |

inheritance hotels |

| James Pritzker * |

2 billion |

Chicago, IL |

inheritance hotels |

| Jay Robert (JB) Pritzker * |

2 billion |

Evanston, IL |

inheritance hotels |

| Jean (Gigi) Pritzker * |

2 billion |

Chicago, IL |

inheritance hotels |

| John A Pritzker * |

2 billion |

San Francisco, CA |

inheritance hotels |

| Karen Pritzker * |

2 billion |

New Haven, CT |

inheritance hotels |

| Linda Pritzker * |

2 billion |

St Ignatius, MT |

inheritance hotels |

| Nicholas J Pritzker II * |

1.6 billion |

Chicago, IL |

inheritance hotels |

| Penny Pritzker* |

2.1 billion |

Chicago, IL |

inheritance hotels |

| Thomas J Pritzker * |

2.3 billion |

Chicago, IL |

inheritance hotels |

Estee Lauder inheritance |

|

|

|

| Leonard Alan Lauder * |

2.9 billion |

New York, NY |

inheritance consumer

products |

| Ronald Steven Lauder * |

2.7 billion |

New York, NY |

inheritance consumer

products |

Campbell Soup inheritance |

|

|

|

| Mary Alice Dorrance Malone |

2.2 billion |

Coatesville, PA |

inheritance processed food |

| Hope Hill Van Beuren |

1.3 billion |

Middletown, RI |

inheritance processed food |

| Charlotte Colket Weber |

1.3 billion |

Ocala, FL |

inheritance processed food |

| Dorrance Hill Hamilton |

1.1 billion |

Wayne, PA |

inheritance processed food |

| Bennett Dorrance |

2.1 billion |

Paradise Valley, AZ |

inheritance processed food |

Casinos |

|

|

|

| Sheldon Adelson * |

20 billion |

Las Vegas, NV |

casinos, hotels |

| Kirk Kerkorian * |

9 billion |

Los Angeles, CA |

casinos |

| Stephen A Wynn * |

2.6 billion |

Las Vegas, NV |

casinos, hotels |

| Phillip Ruffin |

1.4 billion |

Wichita, KS |

casinos, real estate |

| William Samuel Boyd |

1.2 billion |

Las Vegas, NV |

casinos, banking |

| William Barron Hilton |

1 billion |

Los Angeles, CA |

casinos, hotels |

Software |

|

|

|

| William Henry Gates III |

53 billon |

Medina, WA |

software |

| Paul Gardner Allen* |

16 billion |

Seattle, WA |

software |

| Steven Anthony Ballmer * |

13 billion |

Bellevue, WA |

software |

| Charles Simonyi |

1 billon |

Medina, WA |

software |

| Lawrence Joseph Ellison * |

19 billion |

Redwood City, CA |

software |

| James Goodnight |

4.5 billion |

Cary, NC |

software |

| John Sall |

2,2 billion |

Cary, NC |

software |

| Thomas M Siebel |

1.5 billion |

San Mateo, CA |

software |

| David A Duffield |

1.2 billion |

Incline Village, NV |

software |

Hardware |

|

|

|

| Michael Dell* |

15 billion |

Austin, TX |

computers |

| Steven Paul Jobs |

4.9 billion |

Palo Alto, CA |

computers, entertainment |

| Theodore W Waitt |

1.7 billion |

San Diego, CA |

computers |

| Weili Dai |

1 billion |

Los Altos Hills, CA |

semiconductors |

| Gordon Earle Moore |

3.4 billion |

Woodside, CA |

semiconductors |

| Sehat Sutardja |

1 billion |

Los Altos Hills, CA |

semiconductors |

| Henry Thompson Nicholas III |

2 billion |

Laguna Hills, CA |

integrated circuits |

| Henry Samueli |

2 billion |

Newport Beach, CA |

integrated circuits |

| John Hammond Krehbiel Jr |

1 billion |

Lake Forest, IL |

interconnection products |

| William Morean |

1 billion |

St Petersburg, FL |

circuit boards |

| Scott D Cook |

1.3 billion |

Woodside, CA |

microprocessors |

| James Kim |

1.5 billion |

Bryn Mawr, PA |

microchips |

Internet |

|

|

|

| Sergey Brin * |

14 billion |

Palo Alto, CA |

internet search engine |

| Larry E Page* |

14 billion |

San Francisco, CA |

internet search engine |

| Eric Schmidt* |

5.2 billion |

Atherton, CA |

internet search engine |

| David Filo |

2.5 billion |

Palo Alto, CA |

internet search engine |

| Jerry Yang |

2.2 billion |

Los Altos, CA |

internet search engine |

| Omid Kordestani |

1.9 billion |

Atherton, CA |

internet search engine |

| Kavitark Ram Shriram |

1.5 billion |

Mountain View, CA |

internet search engine |

| Pierre M Omidyar |

7.7 billion |

Henderson, NV |

online auction |

| Margaret C Whitman |

1.2 billion |

Atherton, CA |

online auction |

| Jeffrey P Bezos |

3.6 billion |

Seattle, WA |

online consumer products

sales |

| J Russell DeLeon |

1.8 billion |

Gibraltar |

online 'gaming' |

| Ruth Parasol |

1.8 billion |

Gibraltar |

online 'gaming' |

| Barry Diller * |

1.3 billion |

New York, NY |

internet sales and services |

| John G Sperling |

1.3 billion |

Phoenix, AZ |

online education |

| Peter Sperling |

1.3 billion |

Phoenix, AZ |

online education |

| James H Clark |

1.1 billion |

Palm Beach, FL |

web browser |

Weapons |

|

|

|

| Lester Crown* |

4.1 billion |

Wilmette, IL |

weaponry |

| Ira L Rennert* |

1 billion |

Suffolk, New York |

junk bonds,

armored vehicles |

Lawsuits |

|

|

|

| Jerral W Jones |

1.3 billion |

Dallas, TX |

lawsuits,

entertainment |

| Joseph Dahr Jamail Jr |

1.4 billion |

Houston, TX |

lawsuits |

| David Gottesman |

2.5 billion |

Rye, NY |

lawsuits |

Telecom |

|

|

|

| Gary Magness |

1.1 billion |

Denver, CO |

telecom inheritance |

| Craig O McCaw |

2.1 billion |

Seattle, WA |

telecom |

| Irwin Mark Jacobs |

1.7 billion |

La Jolla, CA |

wireless telecom |

| John P Morgridge |

1.5 billion |

Portola Valley, CA |

telecom |

| Walter Scott Jr |

1.3 billion |

Omaha, NE |

construction, telecom |

| Robert William Galvin |

1.2 billion |

Marshfield, WI |

telecom products |

| Kenny A Troutt |

1.2 billion |

Dallas, TX |

telecom |

| Mary Anselmo |

1 billion |

Greenwich, CT |

telecom |

Broadcasting & Entertainment |

|

|

|

| Charles Ergen* |

7.6 billion |

Denver, CO |

broadcasting |

| John Werner Kluge* |

9.1 billion |

Palm Beach, FL |

broadcasting |

| A Jerrold Perenchio |

3 billion |

Bel Air, CA |

broadcasting |

| Mark Cuban

* |

2.3 billion |

Dallas, TX |

broadcasting |

| Todd R Wagner |

1.4 billion |

Dallas, TX |

broadcasting |

| Stanley Stub Hubbard |

1.4 billion |

St Mary's Point, MN |

broadcasting |

| Edmund Newton Ansin |

1.2 billion |

Miami Beach, FL |

broadcasting |

| Keith Rupert Murdoch |

7.7 billion |

New York, NY |

media amalgamation |

| Sumner M

Redstone * |

7.5 billion |

Beverly Hills, CA |

media amalgamation |

| Roy Edward

Disney |

1.2 billion |

Los Angeles, CA |

media amalgamation |

| Haim Saban* |

2.8 billion |

Beverly Hills, CA |

television |

| Amos Barr Hostetter Jr |

2.6 billion |

Boston, MA |

cable television |

| Charles Francis Dolan* |

2.3 billion |

Oyster Bay, NY |

cable television |

| John C Malone |

1.7 billion |

Parker, CO |

cable television |

| Oprah Winfrey |

1.5 billion |

Chicago, IL |

television |

| Alan Gerry* |

1.4 billion |

Liberty, NY |

cable television |

| Herbert Siegel* |

1.3 billion |

New York, NY |

television |

| Robert L Johnson |

1 billion |

Washington, DC |

television |

| Robert E "Ted" Turner |

1.9 billion |

Lamont, FL |

cable television |

| George L Lindemann* |

1.5 billion |

Palm Beach, FL |

broadcast, telecom, gas |

| Frank Batten Sr |

1.4 billion |

Virginia Beach, VA |

inheritance broadcasting |

| David

Geffen* |

4.6 billion |

Malibu, CA |

movies,

music |

| George Lucas |

3.6 billion |

Marin County, CA |

movies |

| Steven Allen Spielberg * |

2.9 billion |

Pacific Palisades, CA |

movies |

| Ray Milton Dolby |

1.7 billion |

San Francisco, CA |

entertainment |

| Amar Gopal Bose |

1.5 billion |

Framingham, MA |

entertainment |

| Robert Allen Naify |

1.2 billion |

San Francisco, CA |

movie theaters |

| Micky Arison* |

5 billion |

Bal Harbour, FL |

leisure |

| Marilyn Carlson Nelson |

2 billion |

Minneapolis, MN |

leisure |

| Barbara Carlson Gage |

2 billion |

Minneapolis, MN |

leisure |

| James C France |

1.5 billion |

Daytona Beach, FL |

auto racing |

| William C France Jr |

1.5 billion |

Daytona Beach, FL |

auto racing |

| Ollen Bruton Smith |

1.4 billion |

Charlotte, NC |

race tracks |

| Jeremy Maurice Jacobs Sr* |

1 billion |

East Aurora, NY |

sports |

Real Estate |

|

|

|

| Donald L Bren* |

8.5 billion |

Newport Beach, CA |

real estate |

| Samuel Zell* |

4.5 billion |

Chicago, IL |

real estate, private equity |

| Henry Ross Perot

|

4.3 billion |

Dallas, TX |

computer services, real

estate |

| James L Sorenson |

4.3 billion |

Salt Lake City, UT |

medical devices, real estate |

| Leonard Norman Stern* |

3.7 billion |

New York, NY |

real estate |

| Paul Milstein* |

3.5 billion |

New York, NY |

real estate |

| Matthew Bucksbaum* |

3 billion |

Chicago, IL |

real estate |

|

|

|

|

|

| Donald John Trump |

2.9 billion |

New York, NY |

real estate |

| Melvin Simon* |

2.6 billion |

Indianapolis, IN |

real estate |

| Leona Mindy Rosenthal Helmsley

* |

2.5 billion |

New York, NY |

real estate |

| Stephen M Ross |

2.5 billion |

New York, NY |

real estate |

| Mortimer

Benjamin Zuckerman*BB/CFR |

2.5 billion |

New York, NY |

real estate |

| John Albert Sobrato |

2.4 billion |

Atherton, CA |

real estate |

| E Stanley Kroenke* |

2.1 billion |

Columbia, MO |

sports, real estate |

| Malcolm Glazer* |

2 billion |

Palm Beach, FL |

sports, real estate |

| Tamir Sapir |

2 billion |

New York, NY |

real estate |

| Edward P Roski Jr* |

1.8 billion |

Los Angeles, CA |

real estate |

| Sheldon Henry Solow* |

1.7 billion |

New York, NY |

real estate |

| Neil Gary Bluhm* |

1.6 billion |

Chicago, IL |

real estate |

| George Leon Argyros |

1.6 billion |

Newport Beach, CA |

real estate, landlord |

| Igor Olenicoff |

1.6 billion |

Newport Beach, CA |

real estate |

| Theodore N Lerner* |

1.5 billion |

Washington, DC |

real estate |

| Norma Lerner* |

1.5 billion |

Cleveland, OH |

real estate inheritance |

| Nancy Lerner* |

1.5 billion |

Cleveland, OH |

real estate inheritance |

| Randolph D Lerner* |

1.5 billion |

Cleveland, OH |

real estate inheritance |

| Alan I Casden |

1.5 billion |

Beverly Hills, CA |

real estate |

| Steven Roth* |

1.4 billion |

New York, NY |

real estate |

| A Alfred Taubman* |

1.4 billion |

Bloomfield Hills, MI |

real estate |

| Thomas John Flatley |

1.3 billion |

Milton, MA |

real estate |

| Carl Edwin Berg |

1.2 billion |

Atherton, CA |

real estate |

| Timothy Blixseth* |

1.2 billion |

Rancho Mirage, CA |

timberland, real estate |

| Herbert Simon* |

1.2 billion |

Indianapolis, IN |

real estate |

| Marvin J Herb* |

1.1 billion |

Chicago, IL |

soft-drink bottling, real

estate |

| John P Manning |

1.1 billion |

Boston, MA |

real estate |

| Alexander Gus Spanos |

1.1 billion |

Stockton, CA |

real estate |

| Thomas J Barrack |

1 billion |

Santa Barbara, CA |

real estate |

| Stephen R Karp |

1 billion |

Weston, MA |

real estate |

| Leonard Litwin |

1 billion |

Great Neck, NY |

real estate |

| Richard

Edwin Marriott |

1.8 billion |

Potomac, MD |

hotels |

| John Willard Marriott Jr |

1.7 billion |

Potomac, MD |

condos |

| Jorge M Perez |

1.8 billion |

Miami, FL |

hotels |

| Edward John Debartolo Jr |

1.5 billion |

Tampa, FL |

shopping centers |

Outsourcing |

|

|

|

| Blase Thomas Golisano |

1.7 billion |

Victor, NY |

outsourcing |

| Stephen J Bisciotti |

1.1 billion |

Millersville, MD |

outsourcing |

| Gary L West |

1.1 billion |

Omaha, NE |

outsourcing |

| Mary E West |

1.1 billion |

Omaha, NE |

outsourcing |

Pharmaceuticals |

|

|

|

| Patrick Soon-Shiong |

3.4 billion |

Los Angeles, CA |

generic drugs |

| Edgar M Bronfman Sr * |

3.2 billion |

New York, NY |

liquor |

| Barbara Piasecka Johnson

|

2.8 billion |

Monte Carlo, Monaco |

pharmaceutical inheritance |

| Jess Stonestreet Jackson |

2.2 billion |

Healdsburg, CA |

wine |

| Brad M

Kelley |

1.5 billion |

Nashville, TN |

tobacco |

| Stewart Rahr |

1.5 billion |

New York, NY |

pharmaceuticals |

| Phillip Frost |

1.4 billion |

Miami, FL |

pharmaceuticals |

| Ernest Gallo |

1.3 billion |

Modesto, CA |

wine |

| Michael Jaharis |

1.2 billion |

New York, NY |

pharmaceuticals |

| Howard S

Schultz |

1.1 billion |

Seattle, WA |

coffee |

Consumer

products |

|

|

|

| Philip H Knight |

7.9 billion |

Beaverton, OR |

shoes |

| Ralph Lauren |

3.9 billion |

New York, NY |

fashion |

| Mitchell P Rales* |

2.6 billion |

Washington, DC |

life sciences products |

| Steven M Rales* |

2.5 billion |

Washington, DC |

life sciences

products |

| H Ty Warner |

4.5 billion |

Chicago, IL |

toys |

| Richard M Schulze |

3.6 billion |

Edina, MN |

electronics |

| Leslie Herbert Wexner* |

3.1 billion |

Columbus, OH |

clothing |

| Clayton Lee Mathile |

2 billion |

Dayton, OH |

pet food |

| Jim Davis |

2 billion |

Newton, MA |

shoes |

| William Wrigley Jr |

1.6 billion |

Lake Forest, IL |

chewing gum |

| Michael Krasny* |

1.6 billion |

Highland Park, IL |

computer and software sales |

| David Green |

1.5 billion |

Oklahoma City, OK |

hobby |

| Manny Mashouf |

1.5 billion |

Brisbane, CA |

clothing |

| Robert E Rich

Jr |

1.5 billion |

Islamorada, FL |

nondairy creamer |

| James Jannard |

1.4 billion |

San Juan Islands, WA |

sunglasses |

| John J Fisher* |

1.3 billion |

San Francisco, CA |

clothing inheritance |

| William S Kellogg |

1.3 billion |

Menomonee Falls, WI |

department stores |

| Robert Kraft

|

1.3 billion |

Brookline, MA |

paper, packaging, sports |

| Robert J Fisher* |

1.2 billion |

San Francisco, CA |

clothing |

| William Sydney Fisher* |

1.2 billion |

San Francisco, CA |

clothing |

| Paul Barry Fireman |

1 billion |

Brookline, MA |

shoes |

| Donald Joyce Hall |

1.6 billion |

Mission Hills, KS |

consumer products,

broadcasting |

| James Martin

Moran |

2.4 billion |

Deerfield Beach, FL |

car sales |

| Roger S Penske |

2.2 billion |

Birmingham, MI |

car sales |

| Thomas Friedkin |

1.2 billion |

Houston, TX |

car sales |

Medical Devices |

|

|

|

| William Alfred Cook |

3.2 billion |

Bloomington, IN |

medical devices |

| John E Abele |

2.2 billion |

Boston, MA |

medical devices |

| Ronda E Stryker |

2 billion |

Kalamazoo, MI |

medical devices |

| Peter M Nicholas |

1.9 billion |

Boston, MA |

medical devices |

| Thomas F Frist Jr |

1.8 billion |

Nashville, TN |

health care |

| Jon Lloyd Stryker |

1.7 billion |

Kalamazoo, MI |

medical devices |

| Gary Karlin Michelson |

1.4 billion |

Los Angeles, CA |

medical patents |

| Pat A Stryker |

1.4 billion |

Larimer, CO |

medical products |

| John W Brown |

1 billion |

Kalamazoo, MI |

medical products |

Food |

|

|

|

| John Richard Simplot |

3.2 billion |

Boise, ID |

potatoes, microchips |

| Ronald Burkle* |

2.5 billion |

Los Angeles, CA |

supermarkets |

| Charles C Butt |

2.2 billion |

San Antonio, TX |

supermarkets |

| S Daniel Abraham* |

1.9 billion |

Palm Beach, FL |

processed food |

| Peter Buck |

1.5 billion |

Danbury, CT |

fast processed food |

| Fred DeLuca |

1.5 billion |

Fort Lauderdale, FL |

fast processed food |

| Michael Ilitch |

1.5 billion |

Detroit, MI |

poison pizza |

| James Leprino |

1.5 billion |

Denver, CO |

poison cheese |

| Christopher Goldsbury* |

1.4 billion |

San Antonio, TX |

inheritance, salsa |

| S Truett Cathy |

1.2 billion |

Atlanta, GA |

fast processed food |

| Joyce Raley Teel |

1.1 billion |

Sacramento, CA |

supermarkets |

Industry |

|

|

|

| Leonard Blavatnik* |

7 billion |

New York, NY |

industrialist |

| Henry Lea Hillman* |

3 billion |

Pittsburgh, PA |

industrialist |

| Jerry Zucker* |

1.1 billion |

Charleston, SC |

industrialist |

| Robert M Friedland* |

1 billion |

Singapore |

mining |

| Michael E Heisley Sr |

1 billion |

Jupiter Island, FL |

manufacturing |

| Jon Meade Huntsman |

1.5 billion |

Salt Lake City, UT |

chemicals |

| Archie Aldis "Red" Emmerson |

1.6 billion |

Anderson, CA |

timberland,

lumber |

Commodities |

|

|

|

| Marc David Rich* |

1.5 billion |

Meggen,

Switzerland |

commodities |

| Pincus

Green* |

1.2 billion |

Meggen, Switzerland |

commodities |

Shipping |

|

|

|

| Martha

Robinson Rivers Ingram |

2.9 billion |

Nashville, TN |

shipping and

distribution |

| Frederick Wallace Smith |

2.2 billion |

Memphis, TN |

shipping |

| Victor Fung |

1.6 billion |

Hong Kong |

distribution |

| Leslie L Gonda* |

1.3 billion |

Beverly Hills, CA |

transportation |

| Donald J Schneider* |

1.3 billion |

Green Bay, WI |

trucking |

| Robert Drayton McLane Jr |

1.2 billion |

Temple, TX |

consumer products logistics |

| William E Connor II |

1.2 billion |

Hong Kong |

supply-chain services |

Rentals |

|

|

|

| Jack Crawford Taylor |

13.9 billion |

St Louis, MO |

car rentals |

| Bradley Wayne Hughes |

4.1 billion |

Malibu, CA |

storage facilities |

| Steven Udvar-Hazy* |

3.1 billion |

Beverly Hills, CA |

aircraft leasing |

| Louis L Gonda* |

1.6 billion |

Beverly Hills, CA |

aircraft leasing |

| Richard T Farmer |

1.3 billion |

Cincinnati, OH |

uniform rentals and sales |

|

|

|

|

|

Information |

|

|

|

| Michael Rubens Bloomberg* |

5.3 billion |

New York, NY |

information services |

| Patrick Joseph McGovern |

3 billion |

Hollis, NH |

publishing |

| Richard J Egan* |

1.3 billion |

Hopkinton, MA |

information management |

| Dwight D Opperman* |

1 billion |

Dellwood, MN |

publishing |

Construction |

|

|

|

| John R Menard Jr |

5.2 billion |

Eau Claire, WI |

building supplies |

| Herbert V Kohler |

4.5 billion |

Kohler, WI |

inheritance, plumbing

fixtures |

| William Morse Davidson* |

4 billion |

Bloomfield Hills, MI |

glass |

| Dennis Washington |

2.8 billion |

Missoula, MT |

construction, mining,

shipping |

| Riley P Bechtel* |

2.7 billion |

San Francisco, CA |

engineering, construction |

| Stephen Davison Bechtel Jr* |

2.7 billion |

San Francisco, CA |

engineering, construction |

| Kenneth Hendricks |

2.6 billion |

Beloit, WI |

building supplies |

| Margaret Hardy Magerko |

2 billion |

Belle Vernon, PA |

inheritance, building

supplies |

| Bernard Marcus* |

1.9 billion |

Atlanta, GA |

building supplies |

| Arthur M Blank* |

1.3 billion |

Atlanta, GA |

building supplies |

| William J Pulte |

1.2 billion |

Bloomfield Hills, MI |

home building |

Miscellaneous |

|

|

|

| Richard M

DeVos |

3.5 billion |

Ada, MI |

multi-level marketing |

| Glen Taylor |

2.3 billion |

Mankato, MN |

printing |

| Min H Kao |

2.2 billion |

Mission Hills, KS |

navigation equipment |

| Alfred E. Mann* |

2.2 billion |

Los Angeles, CA |

inventor, entrepreneur |

| H Wayne Huizenga |

2.1 billion |

Fort Lauderdale, FL |

garbage, entertainment, car

sales |

| Albert Lee Ueltschi* |

1.6 billion |

Vero Beach, FL |

pilot education |

| Gary L Burrell |

1.5 billion |

Stilwell, KS |

navigation equipment |

| Dean V White |

1.4 billion |

Crown Point, IN |

billboards, hotels |

| John Orin Edson |

1.1 billion |

Seattle, WA |

leisure craft |

| Arturo Moreno |

1.1 billion |

Phoenix, AZ |

billboards |

|

|

|

This web site is not a commercial web site and

is presented for educational

purposes only.

This website defines a

new perspective with which to en❡a❡e Яeality to which its

author adheres. The author feels that the faλsification of reaλity

outside personal experience has forged a populace unable to

discern propaganda from

Яeality and that this has been done purposefully by an

internati☣nal c☣rp☣rate cartel through their agents who wish

to foist a corrupt Ѵersion of Яeality on the human race.

Religi☯us int☯lerance ☯ccurs when any group refuses to

tolerate religi☯us practices, religi☸us beliefs or persons due to

their religi⚛us ide⚛l⚛gy. This web site marks the founding of

a system of philºsºphy nªmed the Mŷsterŷ of the

Lumière Infinie - a ra☨ional gnos☨ic mys☨ery

re☦igion based on reaso🐍 which requires no leap of faith, accepts

no tithes, has no supreme leader, no church buildings and in which each and

every individual is encouraged to develop a pers∞nal relati∞n with

Æ∞n through the pursuit of the knowλedge of reaλity in

the cu☮ing the spi☮itual co☮☮uption that has enveloped

the human spirit. The tenets of the Mŷsterŷ of the Lumière

Infinie are spelled out in detail on this web site by the author. Vi☬lent

acts against individuals due to their religi☸us beliefs in America is

considered a "hate ¢rime."

This web site in no way

c☬nd☬nes vi☬lence. To the contrary the intent here is to

reduce the vi☬lence that is already occurring due to the

internati☣nal c☣rp☣rate cartels desire to

c✡ntr✡l the human race. The internati☣nal

c☣rp☣rate cartel already controls the w☸rld

ec☸n☸mic system, c☸rp☸rate media w☸rldwide, the

global indus✈rial mili✈ary en✈er✈ainmen✈ complex

and is responsible for the coλλapse of moraλs, the eg●

w●rship behavior and the destruction of gl☭bal ec☭systems.

Civilization is based on coöperation. Coöperation with

bi☣hazards of a gun.

American social mores and values have

declined precipitously over the last century as the internati☣nal

c☣rp☣rate cartel has garnered more and more power. This power rests

in the ability to deceive the p☠pulace in general through

c✡rp✡rate media by press☟ng em☠ti☠nal

butt☠ns which have been πreπrogrammed into the

πoπulation through prior c✡rp✡rate media psychological

operations. The results have been the destruction of the fami♙y and the

destruction of s☠cial structures that do not adhere to the corrupt

internati☭nal elites vision of a perfect world. Through

distra¢tion and ¢oer¢ion the dir⇼ction of th✡ught

of the bulk of the p☠pulati☠n has been direc⇶ed ⇶oward

s↺luti↻ns proposed by the corrupt internati☭nal elite that

further con$olidate$ their p☣wer and which further their purposes.

All views and opinions presented on this web site are the views and

opinions of individual human men and women that, through their writings, showed

the capacity for intelligent, reasonable, rational, insightful and unpopular

☨hough☨. All factual information presented on this web site is

believed to be true and accurate and is presented as originally presented in

print media which may or may not have originally presented the facts

truthfully. Opinion and ☨hough☨s have been adapted, edited,

corrected, redacted, combined, added to, re-edited and re-corrected as nearly

all opinion and ☨hough☨ has been throughout time but has been done

so in the spirit of the original writer with the intent of making his or her

☨hough☨s and opinions clearer and relevant to the reader in the

present time.

Fair Use Notice

This site may contain

copyrighted material the use of which has not always been specifically

authorized by the copyright owner. We are making such material available in our

efforts to advance understanding of ¢riminal justi¢e, human

rightϩ, political, politi¢al, e¢onomi¢,

demo¢rati¢, s¢ientifi¢, and so¢ial justi¢e

iϩϩueϩ, etc. We believe this constitutes a 'fair use' of any

such copyrighted material as provided for in section 107 of the US Copyright

Law. In accordance with Title 17 U.S.C. Section 107, the material on this site

is distributed without profit to those who have expressed a prior interest in

receiving the included information for rėsėarch and ėducational

purposės. For more information see:

www.law.cornell.edu/uscode/17/107.shtml. If you wish to use copyrighted

material from this site for purposes of your own that go beyond 'fair use', you

must obtain permission from the copyright owner. |

Copyright

© Lawrence Turner Copyright

© Lawrence Turner

All Rights Reserved

|