|

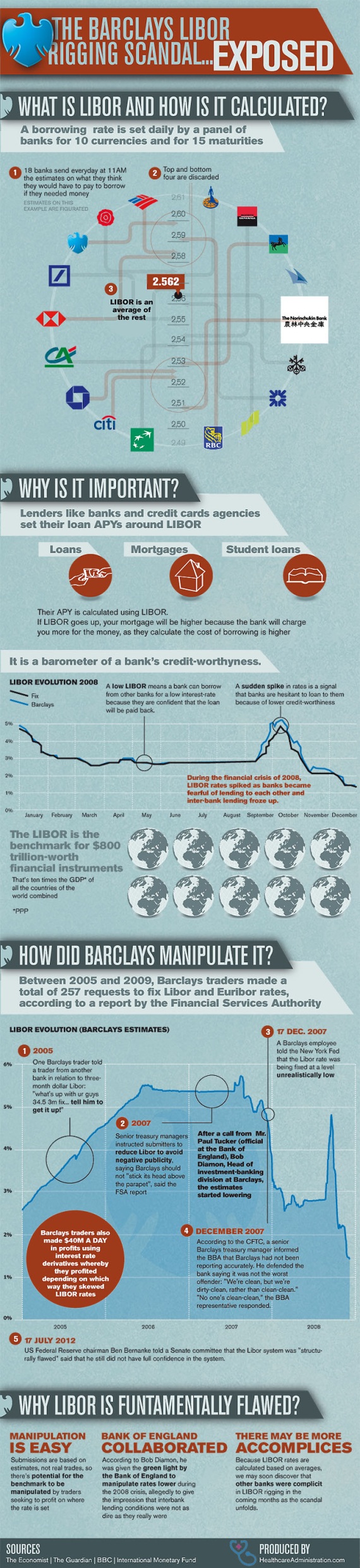

"The Mafia has succeeded in its long-term goal and

has integrated its underground economy with that of the overground.

True

to Michele Sindona's early

prediction, the former has thrown sand into the "immense and recondite

machinery" of the latter the more so since even big money-center banks have

adopted Sindona's standards and practices.

Citigroup, JP Morgan,

Barclays, and Royal Bank of Scotland have all pled guilty to anti-competitive

bid-rigging of exchange

rates.

An unprecedented number of major banks face criminal

charges.

Barclays traders also led the pack in the online chat rooms

dubbed "The Cartel" and "The Bandits Club" in which major banks

colluded to fix the all-important LIBOR, the dominant interbank lending rate

benchmark.

Although the culprits have agreed to pay fines amounting to

$25 billion, the amount is a mere bagatelle compared to the hundreds of

trillions of dollars vested in the notional value of these derivatives." -

Patiricia Goldstone2012 An

international investigation into the London Interbank Offered Rate, or Libor,

revealed a widespread conspiracy by multiple banks - notably Deutsche Bank,

Barclays, UBS, Rabobank, and the Royal Bank of Scotland - to manipulate

interest rates for

profit.

"Our

very human need to not feel threatened by our immediate environment allows us

to ignore certain realities existent in

that environment.

We do this without the conscious

awareness of choosing to ignore.

This is due in large part simple to the

large amount of conflicting data.

Some we sort

consciously and

some we sort subconsciously." -

AA

"Overconfident

judgements are utterly representative' of those made by

professionals in medical

care, financial services -

"expert" decision

making.

In fact, physicists,

economists, and

demographers all suffer

from this bias, even when reasoning about their field of expertise.

When you have a good theory, overconfidence may do less damage.

The problem is people usually

believe they have a good theory." - JD Trout

"Human beings have

a nasty habit of ignoring the cold

hard facts of the present in the hopes of using

apathy as

a magical elixir for future

prosperity.

They

want to believe that disaster is a mindset, that it is a boogeyman under

their bed that can be defeated through

blind optimism." - Brandon Smith

Bonds and stocks are both

securities, the major difference between the

two is that (capital) stockholders have an equity stake in a company (owners),

whereas bondholders have a creditor stake in the company (lenders).

Bondholders have priority over

stockholders in

the event of bankruptcy.

Secured creditors have

priority over bondholders in the event of bankruptcy.

A

futures contract is a

legal contract to buy or sell

an asset at a predetermined price at a specified time in the

future.

A futures option is an

option contract to purchase a

futures

contract.

A

put option is a

contract to sell a specified amount of a

fungible security at

a pre-determined price within

a specified time frame.

A call option is a

contract to buy a specified amount of a

fungible security at a a

specified price within a specific time period.

A derivative contracts value is based on a

fungible asset or

asset index.

Futures contracts, forward contracts,

options, swaps, and warrants

are commonly used derivatives.

Credit default swaps are used by lenders

as a hedge against default.

Interest rate derivatives

are contracts to exchange a notional amount of money on an agreed upon interest

rate - typically a Cost of Funds Index.

A

stock option is a

derivative as value is "derived" from stock.

Derivatives can be used to

hedge or as

insurance.

Three top securities brokers

had offices in the World Trade

Center, Cantor Fitzgerald, Euro Brokers and Garbon Inter

Capital.

Flight 11 struck just under the floors where Cantor Fitzgerald

was located.

An explosion in the vacant 23rd floor of the

North Tower, right

under the offices of the FBI and Garbon Inter Capital on the 25th floor caused

a huge fire from the 22nd through the 25th floors.

Hundreds of billions

of dollars of securities stored in a vault where destroyed in an explosion in

the basement of the North Tower.

Flight 175 slammed into the 78th floor

of the South Tower just below the 84th floor where Euro Brokers were located.

Brian Clark, the manager at Euro Brokers, heard numerous explosions,

apparently unrelated to what he referred to as the oxygen-starved fire caused

by the plane crash.

Richard Wagner, a data retrieval expert, estimated

that more than $100 million in illegal transactions appeared to have rushed

through the WTC computers before and during the disaster on September 11,

2001.

A

Deutsche Bank employee verified that approximately five minutes before the

first plane hit the tower that the Deutsche Bank computer system in their WTC

office was seized by an outside, unknown entity.

On September 26, CBS reported that the amount was more

than $100 million and that seven countries were investigating the irregular

trades.

Two newspapers, Reuters and the New York Times, and other

mainstream media reported that the

CIA regularly monitors

extraordinary trades and economic irregularities to ascertain possible criminal

activities or financial assaults.

In fact, the CIA uses

specialized software,

PROMIS, to scrutinize

trades.

The Federal Reserve, untouched by the crisis at its downtown

offices (as they had everything backed up to a remote location), assumed

emergency powers that afternoon,

$240 billion in securities

are electronically cleared.

"The World Trade Center was destroyed just days

after a heightened security alert was lifted at the landmark 110-story towers,

security personnel said yesterday [September 11]. Daria Coard, 37, a guard at

Tower One, said the security detail had been working 12-hour shifts for the

past two weeks because of numerous phone threats. But on Thursday [September

6], bomb-sniffing dogs were abruptly removed." - NY Newsday

"On the weekend of 9/8, 9/9 there was a 'power

down' condition in WTC tower 2, the South Tower. This power down condition

meant there was no electrical supply for approx 36 hrs from floor 50 up ... Of

course without power there were no security cameras, no security locks on doors

and many, many 'engineers' coming in and out of the tower." - WingTV

1982 ICTS International N.V.

founded by former members of the Shin Bet, Israel's internal security agency,

and El Al airline security agents.

1993 to June

2000

Marvin P. Bush served on the Board of Directors of

Securacom which provided security for the World Trade Center,

United Airlines, and

Dulles International

Airport.

Securacom, later Stratesec, which defined itself as a

"single-source" provider of "end-to-end" security services, including

everything from diagnosis

of existing systems to hiring subcontractors to installing video and

electronic equipment.

Securacom was backed by KuwAm, a Kuwaiti-American

investment firm on whose board Marvin Bush also served.

According to

CEO Barry McDaniel, Securacom handled some of the security at the World Trade

Center up until 911.

Securacom was ordered to change its name, as the result of

a 1995 name infringement suit brought by SecuraComm, a smaller Pittsburgh-based

consultancy.

The court found a deliberate effort by Securacom to

financially "bury" the plaintiff, Ron Libengood, and "take everything he had"

by filing a barrage of frivolous arguments against Libengood and his attorneys

in multiple jurisdictions. Appellate courts opined that Securacom "tried to

prevail by crushing Libengood and his corporation" in a "sweeping attempt to

beat a financially weaker opponent through the

use of vexatious litigation."

The company changed its name to "Stratesec" in 1998.

Stratesec

was delisted from the American Stock Exchange in July 2002 due to inability to

make financing payments to ES Bankest, its primary shareholder.

1998ICTS International NV acquires Huntleigh USA which

provides airline passenger screening services at 47 US airports, including all

the international aviation gateways in the USA.

Israeli citizens Menachem Atzmon

and Ezra Harel take over management of security at the

Boston and Newark

airports.

September

11, 2001 Former Deputy Director of the FBI John P. O'Neil takes over his

new job as security chief of the

World Trade

Center.

John O'Neil resigned from the FBI after 31 years of service

after

Barbara Bodine barred him from following up his

investigation of the

attack on the US$ Cole.

Jim Pierce, a Bush cousin and

managing director of the AON Corporation watches the South Tower from the

nearby Millennium Hotel.

Pierce arranged a conference to be held on

105th floor this morning.

However, the previous night, the conference is

moved to Millennium Hotel.

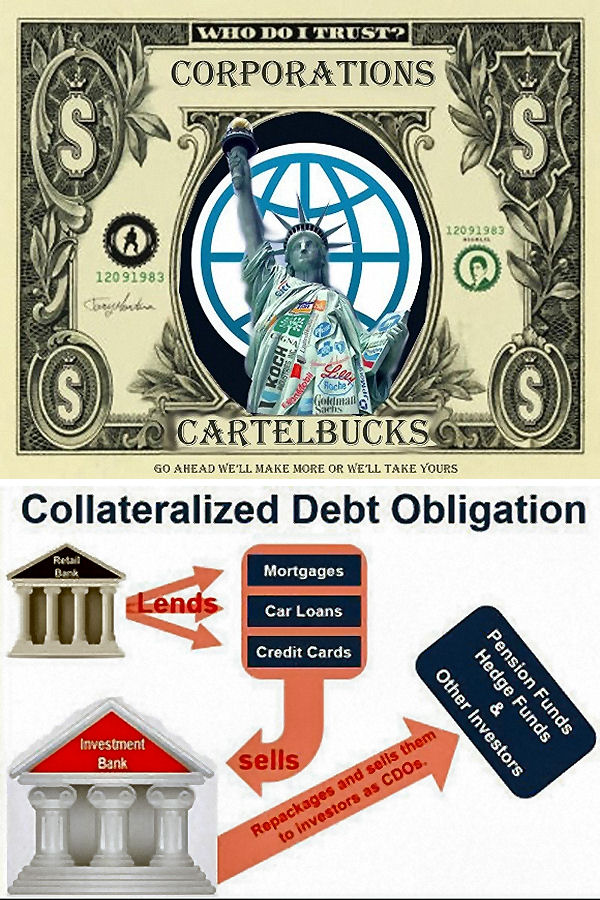

collateralized debt

obligations

"There was nothing accidental about the

crisis."

Paul

Krugman

"More than 100 securities

cases involving losses of $400 billion were filed against financial firms last

year, according to Cornerstone Research." - Vikas Bajaj

01/19/08

"Let's hope we are all

wealthy and retired by the

time this house of cards falls." - Standard & Poor analyst 'texting' about

OTC CDO.

"Auction-rate preferred

securities is the largest fraud ever

perpetuated by Wall Street on investors." - Harry Newton

"This has

gone beyond Greece, at this point, the markets smell the blood, and they're

picking off each weak link." - Win Thin, senior currency strategist at

Brown Brothers

Harriman commenting of the Greek meltdown

"I think virtually

everybody associated with the financial world contributed to it. Some of it

stemmed from greed, some from stupidity,

some from people saying the other guy was doing it." - Warren Buffet on the

meltdown

"Over the last 20 years American financial institutions have

taken on more and more risk, with the blessing of regulators, with not a word

from rating agencies, which, incidentally, are paid by the issuers of the bonds

they rate.

American

International, Fannie Mae,

Freddie Mac, General Electric and municipal bond guarantors

Ambac Financial and MBIA had triple-A rating.

In pursuit of their own

short term earnings, they did exactly the opposite of what they were meant to

do: rather than expose financial risk they systematically disguised it. " -

Michael Lewis & David Einhorn

2007 S&P,

Moody's and Fitch control 98% of the US

debt ratings market.

From the start of 2007 until

September 2008

Moody's Investors

Service downgraded more than $449 billion in marketable securities similar

to Gemstone VII or 82% of all those outstanding.

Moody's also

downgraded more than three-quarters of collateralized debt obligation securities it

once rated AAA.

The three credit rating corporations graded Lehman

Brothers debt A-1 the day it filed for bankruptcy.

State regulators depend on

credit grades to monitor the safety of bonds held by US insurance companies.

The rating companies reaped a bonanza in fees as they worked with

financial firms to manufacture collateralized

debt obligations.

On Sept. 16, one day after the three credit

rating firms downgraded American International Group double-A score by two to

three grades, private contract provisions that it had with banks around the

world based on credit rating changes forcing the insurer to hand over billions

of dollars of collateral.

Credit raters are paid by the companies whose

debt they analyze so ratings will always reflect a bias.

Credit raters

are likely to charge $400 million in fees to taxpayer's for TALF credit

ratings.

"To promote competition, in the 1970s ratings

agencies were allowed to switch from having investors pay for ratings to having

the issuers of debt pay for them.

That led the ratings agencies to

compete for business by currying favor with investment banks that would pay

handsomely for the ratings they wanted. Wall Street paid as much as $1 million

for some ratings, and ratings agency profits soared.

This new revenue

stream swamped earnings from ordinary ratings." - Kevin G. Hall

"In

2001, Moody's had revenues of $800.7 million; in 2005, they were up to $1.73

billion; and in 2006, $2.037 billion.

The exploding profits were fees

from packaging and granting the top-class AAA ratings, which were supposed to

mean they were as safe as US government securities." - Lawrence McDonald

"Ratings agencies abjectly failed in serving the interests of

investors.

They've benefited from the

monopoly status achieved with a

tremendous amount of assistance from regulators." - SEC Commissioner Kathleen

Casey

Five days before filing for bankruptcy

Richard Severin Fuld Jr. assures

investors that Lehman Brothers has $42 billion in

liquidity.

"How does $42 billion

vanish in five days. Did Lehman officers know of harbingers of

doom they weren't

sharing?" - Roger Parloff

"Moral hazard" is a term

commonly applied to financial contracts, under which

one party is obliged to pay

another money if a specified event occurs.

Moral hazard refers to

situations in which the very existence of the contract

alters the behavior of one party

increasing the

probability of the hazard actually taking place.

September 2008 Until

September, the month of the Lehman Brothers

bankruptcy, the Federal Reserve had held the expansion of the

Monetary Base virtually

flat.

US Treasury Secretary

Timothy Franz Geithner, decides

to let Lehman

Brothers fail "to teach a lesson".

On October 7, 2008, the Federal

Reserve announced that it was using its emergency authority under Section 13(3)

of the Federal Reserve Act to establish a Commercial Paper Funding

Facility.

By the end of October, the Federal Reserve had purchased

more than $100 billion in commercial paper.

October 2,

2008 George W Bush signs the $700 billion Emergency Economic

Stabilization Act (EESA) of 2008 after Treasury Secretary Henry Paulson

asked Congress to approve a bailout to buy mortgage-backed securities in danger

of defaulting.

"Under the Paulson Plan,

the government would buy mortgages

and mortgage-backed securities for more than they are worth.

Among

the companies that most vigorously pushed the idea were the

American International Group

and Freddie Mac.

Federal Reserve and

Treasury think that the prices have fallen too far.

The goal is to

recapitalize the banking system by placing a floor under the prices of

securities that never should have been issued." - Floyd Norris

December 2008 A

quarterly report issued by the

Bank of International Settlements

states the total outstanding notional amount of over-the-counter (OTC) derivatives in the world is

$683 trillion while the gross market value for those same instruments was $22

trillion.

Bank like investment strategies - such as the use of leverage

and financing long-term investments with short-term debt - became common

outside the safety net provided by

deposit insurance and

strong regulation.

As a result nonbank institutions became vulnerable to

runs.

If markets lost

confidence their sources of funds could dry up.

Complexity reduces

transparency.

"Neither regulators nor market participants can easily

assess the true financial condition of firms

that hold or trade these derivatives.

Since large parts of

derivatives markets are unregulated, there

is a global web of financial claims and

counterclaims that is essentially invisible to financial supervisors and

market participants alike.

Key characteristics that produced this

systemic vulnerability include:

the use of complex financial

instruments, whose value is often linked

by complex formulae to the value of other instruments or financial

variables;

extensive use

of leverage, or borrowed funds, which permits larger market positions with

a given capital base, increasing potential profits (and losses);

the practice of moving risky financial

speculation off the books, into

nominally

independent accounting entities, so that the results do not appear in the

financial accounts of the parent financial institution." - Mark

Jickling

|

|

|

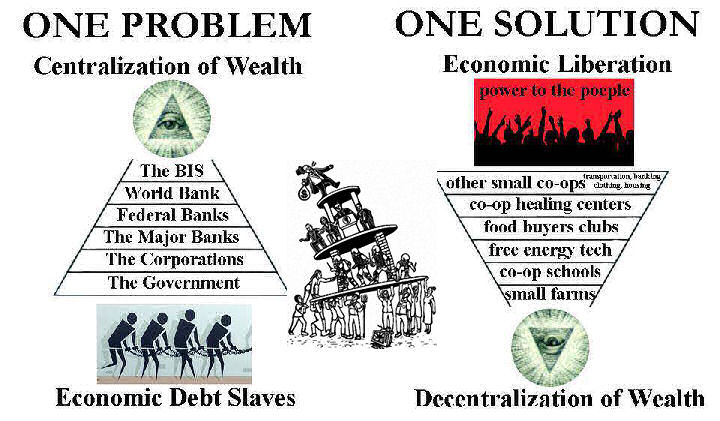

This web site is not a commercial web site and

is presented for educational purposes only.

This website defines a new

perspective with which to en❡a❡e Яeality to which its

author adheres. The author feels that the faλsification of reaλity

outside personal experience has forged a populace unable to

discern pr☠paganda

from Яeality and that this has been done purposefully by an

internati☣nal c☣rp☣rate

cartel through their agents who wish to foist a corrupt version of

reaλity on the human race. Religi☯us int☯lerance ☯ccurs

when any group refuses to tolerate religious practices, religi☸us beliefs

or persons due to their philosophical ideology. This web site marks the

founding of a system of philºsºphy nªmed The Truth of the Way of

the Lumière Infinie - a ra☨ional gnos☨ic mys☨ery

religion based on reaso🐍 which requires no leap of faith, accepts no

tithes, has no supreme leader, no church buildings and in which each and every

individual is encouraged to develop a pers∞nal relati∞n with

Æ∞n through the pursuit of the knowλedge of reaλity in

the hope of curing the spiritual c✡rrupti✡n that has enveloped

the human spirit. The tenets of The Mŷsterŷ of the Lumière

Infinie are spelled out in detail on this web site by the author. Vi☬lent

acts against individuals due to their religi☸us beliefs in America is

considered a "hate ¢rime."

This web site in no way

c☬nd☬nes vi☬lence. To the contrary the intent here is to

reduce the violence that is already occurring due to the internati☣nal

c☣rp☣rate cartels desire to c✡ntr✡l the human race.

The internati☣nal c☣rp☣rate cartel already controls the

w☸rld ec☸n☸mic system, c☸rp☸rate media

w☸rldwide, the global indus✈rial mili✈ary

en✈er✈ainmen✈ complex and is responsible for the collapse of

morals, the eg● w●rship and the destruction of gl☭bal

ec☭systems. Civilization is based on coöperation. Coöperation

with bi☣hazards at the point

of a gun.

American social mores and values have declined

precipitously over the last century as the internati☣nal

c☣rp☣rate cartel has garnered more and more power. This power rests

in the ability to deceive the p☠pulace in general through

c✡rp✡rate media by press☟ng em☠ti☠nal

butt☠ns which have been πreπrogrammed into the

πoπulation through prior c✡rp✡rate media psychological

operations. The results have been the destruction of the fami♙y and the

destruction of s☠cial structures that do not adhere to the corrupt

internati☭nal elites vision of a perfect world. Through distra¢tion

and coercion the dir⇼ction of th✡ught of the bulk of the

p☠pulati☠n has been direc⇶ed ⇶oward

s↺luti↻ns proposed by the corrupt internati☭nal elite that

further con$olidate$ their p☣wer and which further their purposes.

All views and opinions presented on this web site are the views and

opinions of individual human men and women that, through their writings, showed

the capacity for intelligent, reasonable, rational, insightful and unpopular

☨hough☨. All factual information presented on this web site is

believed to be true and accurate and is presented as originally presented in

print media which may or may not have originally presented the facts

truthfully. Øpinion and

☨hough☨s have been adapted, edited, corrected, redacted, combined,

added to, re-edited and re-corrected as nearly all opinion and

☨hough☨ has been throughout time but has been done so in the spirit

of the original writer with the intent of making his or her

☨hough☨s and opinions clearer and relevant to the reader in the

present time.

Fair Use Notice

This site may contain

copyrighted material the use of which has not always been specifically

authorized by the copyright owner. We are making such material available in our

efforts to advance understanding of ¢riminal justi¢e, human

rightϩ, political, politi¢al, e¢onomi¢,

demo¢rati¢, s¢ientifi¢, and so¢ial justi¢e

iϩϩueϩ, etc. We believe this constitutes a 'fair use' of any

such copyrighted material as provided for in section 107 of the US Copyright

Law. In accordance with Title 17 U.S.C. Section 107, the material on this site

is distributed without profit to those who have expressed a prior interest in

receiving the included information for rėsėarch and ėducational

purposės. For more information see:

www.law.cornell.edu/uscode/17/107.shtml. If you wish to use copyrighted

material from this site for purposes of your own that go beyond 'fair use', you

must obtain permission from the copyright owner. |

Copyright

© Lawrence Turner Copyright

© Lawrence Turner

All Rights Reserved

|